The Organization of the Petroleum Exporting Countries (OPEC) set the oil market on fire by announcing a production cut of 1 million barrels per day beginning in May. Although many experts weren’t surprised that a cut occurred, the size of the cut was unexpected.

Taking one million barrels of oil a day offline will have an impact on the global economy. Inflation is likely to remain high as rising oil prices will impact producer costs and are likely to keep wage pressures high. But investors should always take what the market gives us. And right now, that means it’s a good time to buy oil stocks.

After being among the best performers in 2022, many oil stocks will be underperforming in 2023. Falling oil prices amid expectations of lower demand are to blame. Investors are also looking at governmental policies which clearly look to limit the use of fossil fuels.

The OPEC production cut doesn’t change any of those macroeconomic challenges, but it does create an opportunity. One way to manage the risk in that opportunity is to look at the big oil stocks. These blue-chip companies offer share price growth and pay great dividends to boost your total return.

The Biggest May Still Be the Best

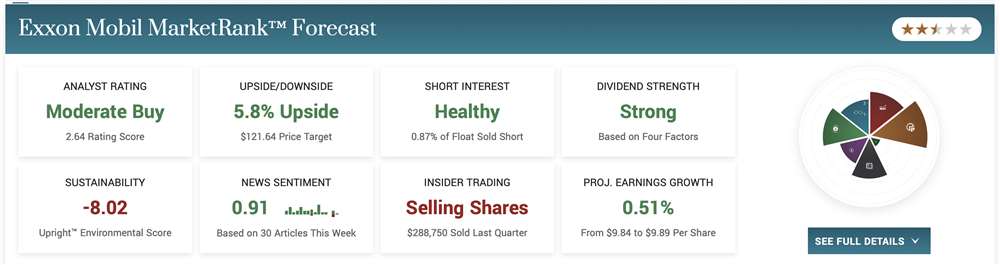

If you’re looking for a must-have oil stock, it’s hard to argue against adding some Exxon Mobil Corporation NYSE: XOM stock to your portfolio. Exxon Mobil is the world’s largest integrated oil and gas company, with plans to increase its daily production of oil equivalent barrels to 4.2 million by 2027.

Exxon has a strong balance sheet that includes the recent retirement of $7 billion of debt. The company also is in the midst of a $50 billion share repurchase program between now and 2024.

In the last three years, XOM stock has climbed 193%. That takes into account the stock being near historic lows at the onset of the pandemic. But even if you widen the lens to five years, the stock price has increased 47%, and that doesn’t account for dividends. Exxon Mobil is a dividend aristocrat, having increased its dividend for 40 consecutive years. And with a payout ratio of 27%, that’s a streak that’s unlikely to end anytime soon.

A Company That Continues to Work Its Plan

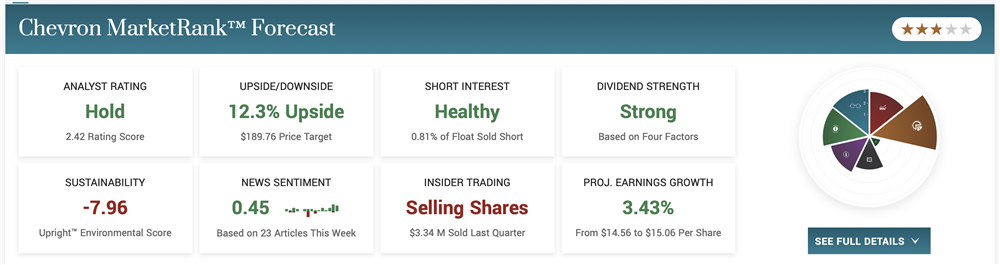

Chevron Corporation NYSE: CVX is another solid choice for investors looking for oil companies with rock-solid balance sheets. Chevron’s focus on capital discipline is really quite impressive. The company has a 3% net debt ratio that highlights management’s objective of paying down debt every quarter.

As part of its strategic plan, Chevron plans to grow its upstream business at a compound annual growth rate (CAGR) for production of 3% by 2027. Some investors may say the reason for the company’s capital discipline is that the company hasn’t made major investments in renewable energy. However, Chevron is also one of the world’s largest suppliers of liquefied natural gas (LNG). Europe relies on LNG for much of its energy needs, and with the war in Ukraine showing no signs of ending, Chevron is one of the companies helping to keep the continent supplied.

Like Exxon Mobil, Chevron rewards shareholders with its share buyback program with a yearly repurchase rate of around $15 billion. And Chevron is also a Dividend Aristocrat, having increased its dividend in the last 37 years. The company currently offers shareholders an annualized dividend of $6.04 per share with a 3.57% yield.

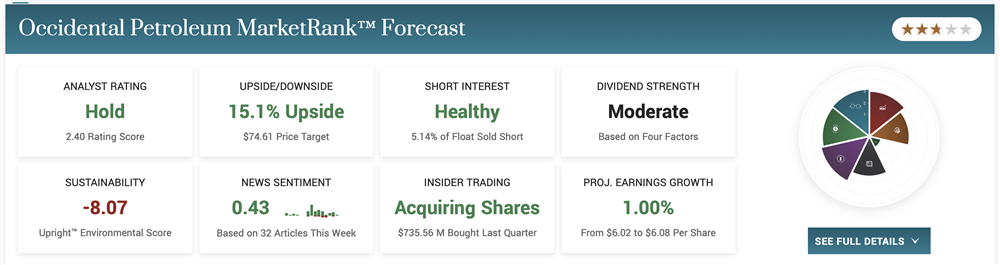

A Company That is Showing Cash is King

The last stock on this list is the Occidental Petroleum Corporation NYSE: OXY. The stock has long been a favorite of Warren Buffett. And the Oracle of Omaha must have known what he was doing by making a bullish buy on OXY stock at the end of February 2023. OXY stock is up 7% in the month since that purchase which brought Berkshire Hathaway’s NYSE: BRK.B total position in Occidental to over 200 million shares that total over $12 billion.

For those that believe in a bet on the jockey strategy, one reason for Buffett’s bullishness in OXY stock is his belief that chief executive officer Vicki Hollub is “running the company the right way.” That belief is reflected in a business that has averaged 25% growth in the last five years and has given investors a return of over 83% in the last three years.

Occidental cut its dividend during the pandemic to preserve cash. But as Thomas Hughes wrote after the company’s last earnings report, the company increased its dividend payment by 38% and has room for more increases in the future.

Before you consider Exxon Mobil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Exxon Mobil wasn't on the list.

While Exxon Mobil currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.