Just when Wall Street thought it was after getting through all the uncertainty around future steps from the Fed regarding monetary policy, yesterday was a stark reminder that when it comes to the stock market, nothing is certain. After giving investors a couple

of record highs to start the year with, the benchmark S&P 500 index went on to drop 2% yesterday, selling all the way into the close.

The catalyst for the drop, which was felt hardest by tech companies, was fresh comments from the Fed’s Jerome Powell about how they might raise rates earlier than previously forecasted. Equities already experienced a fair bit of volatility in Q4 as they adjusted to higher interest rates, and the news that the cycle might be brought forward has understandably caused investors to re-think their fair value levels.

Let’s take a look at some of the harder hit well-known names that might be worth considering after yesterday’s drop.

Shares of the world’s most popular CRM platform hit an all time high as recently as last November, but are down more than 25% thanks in large part to yesterday’s 8% drop. Still, they’re only back to levels they were trading at last summer and there’s a lot to like about Salesforce that might not be immediately apparent.

Their Q3 numbers, released just over a month ago showed revenue growing more than 25% year on year and was well ahead of what analysts had been expecting as was their EPS print. In addition, management saw fit to raise their forward guidance for 2022 at the time which is one of the most bullish signals they can give to investors.

Despite this however, the stock has struggled to catch a bid in recent weeks. Even a strong buy call from Wolfe Research last week hasn’t been enough, as the team there called Salesforce one of their top picks for 2022. They like its “leadership steam, its $27.7 billion acquisition of Slack, and its renewed focus on margins”. And with its stock RSI now under 30, suggested oversold conditions, it’s surely worth considering picking up some shares here.

Similar to Salesforce, Adobe’s stock hit an all time high in November but is down more than 25% since then. With a 7% drop yesterday alone, it was one of the worst mega-cap performers on the day. But this is still a $245 billion company that’s growing revenue 20% year on year according to their last earnings report.

To be fair, that same earnings report saw management rein in their forward guidance slightly, but you have to be thinking that after seeing a full 25% taken off their share price since, this has been adequately priced in. Investors should look for Adobe shares to put in a low in the near term, as a bounce is almost certain to come with the RSI below 30.

Fresh bearish comments from UBS yesterday that identified concerns around slowing growth will need to be addressed, but for those with a long enough time horizon, this is starting to look like a behemoth that is trading at a discount.

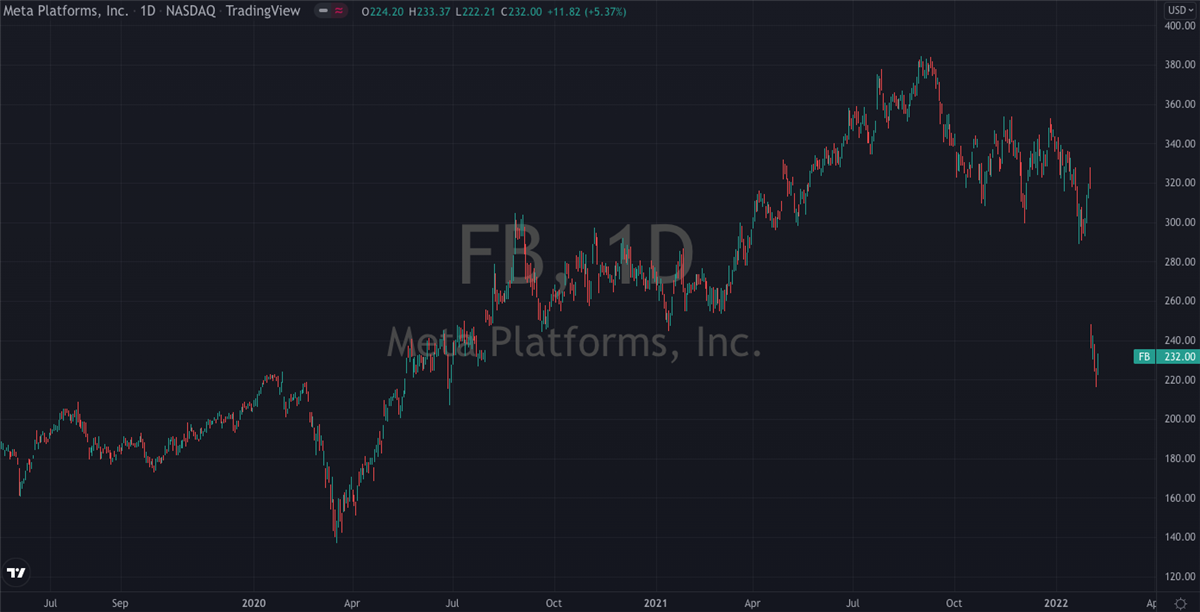

Meta Platforms, more commonly known by its former name Facebook, is among the better performing of the FAANG group in recent weeks. Their shares are only down 15% from last year’s all time high and are still well above their low in December.

The team over at J.P.Morgan had zero qualms about adding them to their top internet stocks for 2022 list last month, and this vote of confidence should be enough for any of us to start thinking about snapping up some shares after yesterday’s 4% dip.

J.P.Morgan analyst Doug Anmuth wrote in a note to clients at the time that he liked Meta’s "

strong profitability & reasonable valuation given the rising interest rate environment, with durable growth and more table stakes." Strong performance from their Oculus virtual reality headset over the holiday season is also sure to strengthen the bid once this week’s volatility starts to peter out.

Before you consider Meta Platforms, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Meta Platforms wasn't on the list.

While Meta Platforms currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.