DraftKings Today

$38.57 +0.23 (+0.60%) (As of 05:19 PM ET)

- 52-Week Range

- $28.69

▼

$49.57 - Price Target

- $51.00

Digital sports betting and iGaming app provider DraftKings Inc. NASDAQ: DKNG has been in hypergrowth mode through 2024 but continues to lose money and even issued downside guidance for 2024. The company, along with competitor FanDuel, owned by Flutter Entertainment plc NYSE: FLUT, faces further scrutiny over anticompetitive practices. United States Senators Peter Welch and Mike Lee want the U.S. Federal Trade Commission (FTC) to investigate as they purport the two computer and technology sector companies control nearly a 90% market share of the online betting market in the United States.

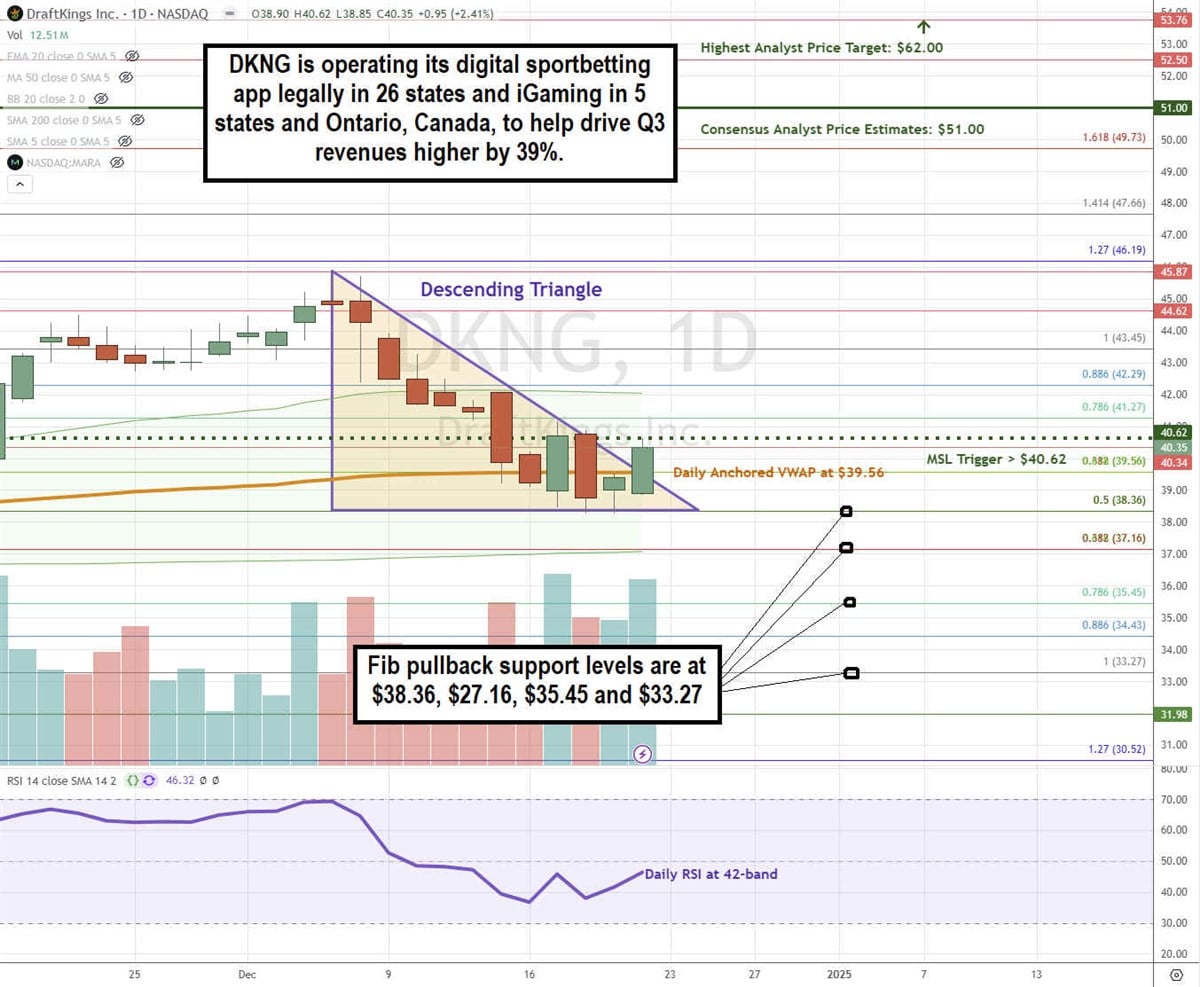

This has caused shares to sell off for seven straight sessions to its daily anchored VWAP support level at $39.56. Here are five reasons for bullish investors who have been waiting for a pullback to bet on DraftKings in 2025.

1) DraftKings Continues to Grow Revenue at Double-Digit Rates

Growth is still ongoing at DraftKings, as illustrated by the 39% YoY revenue growth in Q3 to $1.1 billion. The company has grown its monthly unique payors (MUPs) by 55% to 3.6 million. DraftKings is the third-largest sports betting platform in the United States. Its third quarter marked the return of NFL football and college football betting season. Revenue growth was driven by the efficient acquisition of new customers, healthy customer engagement, expansion into new jurisdictions, high hold percentages, and the acquisition of Jackpocket Inc., which is an app that enables users to buy lottery tickets on their mobile devices.

Jackpocket users can pick their games and numbers, which Jackpocket fulfills, and scan the ticket with an order confirmation. Tickets are stored safely in a fireproof safe. Prizes under $600 get credited to the user's Jackpocket account, while larger wins get the ticket delivered to the user. Jackpocket collects a 7% to 10% fee on the transactions as the user keeps all the winnings. Jackpocket also has live dealer and digital casino games.

2) DraftKings Will Benefit From Continued Legalization of Online Sports Betting

Online sports betting is proving to be an effective way for states to generate tax revenues. As of Dec. 21, 2024, DraftKings is currently legal and lives in 26 states (technically, 25 states and the District of Columbia) and Ontario, Canada. This represents 49% of the United States and 40% of Canada’s population. It also has in-person betting available in 14 states. DraftKings has horse racing betting in 20 states. Missouri was the latest state to legalize sports betting on Nov. 5, 2024, which DraftKings plans to launch in 2025 pending regulatory approval.

Anticipation of high for new states legalizing sports betting and iGaming. California is the largest potential market for legalizing online sports betting. However, it faces heavy opposition from tribal casinos. A previous attempt at legalization through Proposition 27 failed in 2022. Texas is the second largest potential market, but an attempt was made in 2023, but it was voted down. Florida, Georgia, and Minnesota are the next largest potential markets for DraftKings.

3) iGaming Legalization Is a Growth Driver

iGaming is the term used for online gambling through online casinos, which can include a multitude of slots, keno, digital, and live table games like blackjack, poker, and roulette. DraftKings operates only in five states, including Ontario and Canada, with its iGaming platform. While DraftKings doesn't provide specific states, iGaming margins are much higher (70% to 90%) than sports betting margins (5% to 10%). This is because the house always has an edge built into casino games along with a higher frequency of play with digital. In contrast, sports betting only offers a "vig," also called a hold, that DraftKings receives for facilitating the bets.

5) DKNG Stock Is Attempting an MSL Breakout of a Descending Triangle Pattern

A descending triangle is normally a bearish chart pattern indicator of lower highs on the bounce against flat bottom support. The descending upper trendline converges with the flat-bottom horizontal lower trendline support at the apex point. A breakdown triggers if the stock falls below the lower trendline support. A breakout triggers if the stock surges above the upper trendline resistance.

A market structure low (MSL) buy signal triggers above the high of the higher low candle following the three candle formation comprised of a low, lower low, and higher low.

After forming a swing high at $45.87, DKNG proceeded to form ten consecutive lower low candles before the higher low green candle formed above the daily anchored VWAP at $39.56. The high of the higher-low candle is $40.62, which also markets the MSL buy trigger. The descending triangle breakout can trigger if DKNG can bounce up through $40.62. The daily RSI is slowly rising through the 42-band, potentially gaining momentum. Fibonacci (Fib) pullback support levels are at $88.22, $84.35, $76.99, and $73.06.

DKNG's average consensus price target is $51.00, implying a 26.39% upside and its highest analyst price target sits at $62.00. The company has received Buy ratings from 23 analysts and Hold ratings from three. The stock has a 2.23% short interest.

Actionable Options Strategies: Bullish investors can consider using cash-secured puts at the Fib pullback support levels to buy the dip. If assigned the shares, then writing covered calls at upside Fib levels executes a wheel strategy for income opportunities while hedging the downside with the premiums received.

Before you consider DraftKings, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DraftKings wasn't on the list.

While DraftKings currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.