The takeaway from Q2 earnings results for the retail sector is that consumer habits have changed. Once flush with stimulus cash and little to do but spend it, the consumer buys less discretionary items in favor of everyday items like food, health, and personal grooming. While some emerged as clear losers, not all is lost.

There are clear winners in the retail stocks world that are delivering returns for investors now and will continue to do so this year. Among them are industry leaders, membership clubs, off-price retailers, and the retail-oriented technology that helps them succeed.

Win with the Industry-Leading Retail Stock

One of the trends among retailers is that the industry leaders are winning, which is particularly true with Walmart NYSE: WMT. Its size and scale allow it to command the healthiest supply chain and provide consumers with more of what they want when they want it. Those strengths allowed it to take share from Target NYSE: TGT, which is suffering in grocery, among other categories that Walmart dominates.

The most telling evidence is that Walmart grew top and bottom line results and produced a beat-and-raise quarter compared to Target, which produced mixed results and lowered guidance. Walmart pays an average 1.45% yield, but the mediocre payout is compounded by reliability, growth, and share repurchases (as well as the company’s dominant position).

Member Clubs Attract Shoppers Who Come Back

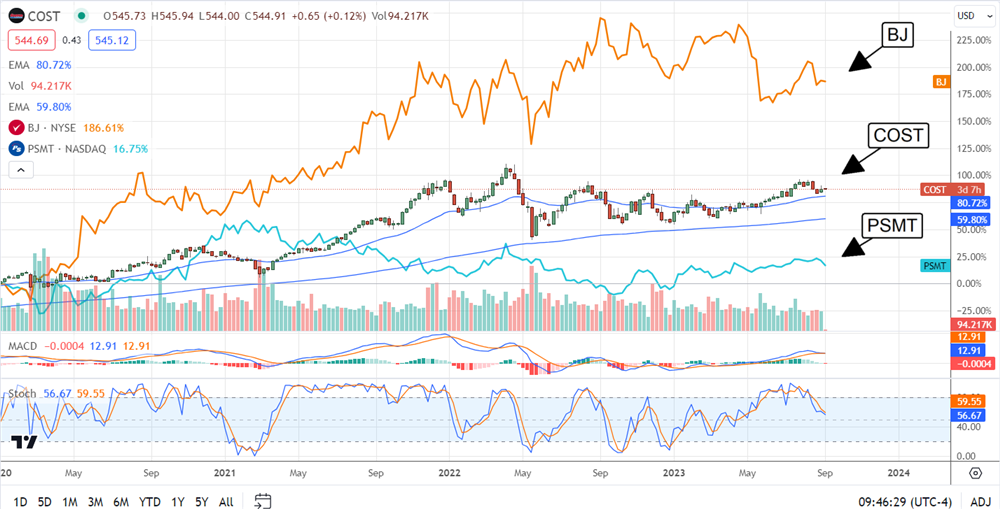

Member clubs have been popular for years, and their attractive qualities continue to draw new shoppers. Among the takeaways from reports that include Costco NYSE: COST, Walmart’s Sam’s Club, BJ’s Wholesale Club NYSE: BJ and PriceSmart Inc. is that mid-single to low-double-digit member growth is sustained throughout the group.

The leader in this group is Costco, but all are supported by secular trends that include cost-conscious shoppers. Costco and PriceSmart NASDAQ: PSMT pay dividends, but each has a uniquely attractive quality. BJ’s Wholesale Club offers value and growth, while PriceSmart is exposed to emerging markets and growth.

Off-Price Retail gets Full Value for Investors

Off-price retail emerged as a clear winner due to shopping down. Industry leaders like TJX Companies NYSE: TJX grew in categories such as apparel and home goods and took market share compared to last year. This is noteworthy because Walmart and Target reported weakness in those areas. TJX is another stock that pays an average yield compared to the S&P 500 but a yield investors can bank on.

The company suspended the payout during the pandemic to preserve its balance sheet but has since reinstated it at a level consistent with the growth trajectory, and growth has also resumed. Besides the pandemic, the company has only ever increased the payout and is positioned to continue that trend. Kohl’s NYSE: KSS is another interesting name in off-price retail; it pays more than 7.0% in yield.

Retail Theft is Rising: Here’s How to Profit from Shrinkage

Shrinkage is a growing problem due to more than mere theft. While theft is rising, supply chain management is another area of need supported by the EAS market. EAS is electronic article surveillance, an industry focused on tracking inventory as it flows from supplier to checkout. The goal is to create accurate records and prevent theft within and without the company. Among the leaders in this industry are CDW NASDAQ: CDW and Avery Dennison Corporation NYSE: AVY, which offer enterprise-level solutions for businesses that include and expand upon EAS tracking. Both pay reliable dividends that come with an expectation for distribution growth.

Retail Tech Helps with Efficiency and Conversion

There are various retail tech companies helping retailers with efficiency and conversions. The leader is Salesforce.com NASDAQ: CRM, a customer relationship management platform. It helps businesses create efficient workflows while tracking customer data and providing revenue-generating insights. The business was recently boosted by the 1st price increase in years and a lean into AI, which has also put it at the top of AI services. Shopify NYSE: SHOP is another retail tech business investors should have on their watchlists.

Before you consider Walmart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walmart wasn't on the list.

While Walmart currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.