The Chinese equity market has been out of favor since the United States decided to stimulate the economy with newly printed dollar bills and rock-bottom interest rates as a way to pull the nation out of the slump brought on by the COVID-19 pandemic. While the American equity market has received all the attention and preference from investors, through investment influx as well as overall bullishness with earnings multiples exceeding the historical norm of 18x to 20x.

While equity values remained compressed in China, fundamentals took a different turn for the better. Companies across all sectors showcased signs of healthy and even aggressive recovery, returning several names to expansion territory when compared to pre-pandemic fundamental levels. Namely, companies operating in the consumer discretionary space and commerce as a whole saw double-digit growth in top and bottom lines, as well as expanding margins accruing from deeper discounts due to their compressed valuations in the open market.

Now that the script is playing out globally, the United States is facing inflationary pressures, which sparked the rise of interest rates and the tightening of overall monetary policy. While the once hottest stock market in the world cools down, in China, economic policy is still looking for ways to stimulate the nation. By rolling out a one trillion Yuan stimulus plan (translating to roughly $146 billion USD), the country plans to reignite infrastructure spending - and jobs - as well as to bring the consumer sector, real estate, and other discretionary spaces back to a booming cycle.

Alibaba Regaining Some Attention

Alibaba Group NYSE: BABA has seen a volatile few quarters as of late. The stock price saw swings of over 60% as it traded in a channel pattern through the better part of 2022, and this pattern seems to be consistently going into 2023 so far. However, as the Chinese equity markets become more popular amongst big investors, this range may be broken sooner than later.

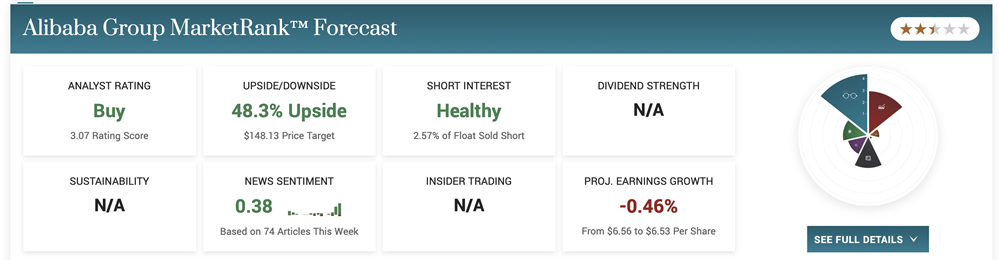

Analysts have long placed target prices around the $148-$180 mark, however, these targets may soon be updated to reflect the biggest push for appreciation since the company's IPO in 2014. Luck often seems to follow value investors, who by naturally picking out of favor winning businesses get to be first and entrenched by the time news and positive developments come out. Investor Dr. Michael Bury reportedly bought 50,000 American Depository Receipts (ADRs) in the Chinese e-commerce giant during the fourth quarter of 2022, along with billionaire investor David Tepper.

It was - and is - pretty common knowledge in the investment community that Alibaba shares were relatively cheap, eyeing them in a comparable basis carrying multiples that would make the firm look like a stagnant and boring utility company. 4.0x price-to-earnings ratio as of 2022, and the next twelve months price to earnings ratio is not looking any better as it will still remain below 10x. These valuations are severely out of touch with a company that has been growing at compounded average growth rates (CAGR) of over 20% across the board and operates an arsenal of business segments riding the tailwind of the fastest-growing middle-class in the world.

Divide and Conquer

This week the company announced its plans to spin off the conglomerate into six main businesses as it explores further IPOs for these underliers. Markets initially reacted with massive optimism, pumping the stock by a frenetic 14% in a single day. This optimism stems from the possible valuation Alibaba may enjoy as it spins off these fast-growing businesses for several reasons.

Chinese regulators have been pressing for a breakup of the big tech firms in the country. Names like Alibaba, Baidu NASDAQ: BIDU, Tencent Holdings OTCMKTS: TCEHY, and JD.com NASDAQ: JD saw consistent pressure from multiple officials throughout the 2020-2022 period, advocating for a break-up of power over monopolistic and data concerns.

This voluntary breakup by Alibaba will effectively shake off regulator pressure and further concerns, as the smaller units will be able to operate independently of the mothership and provide regulators with a wider scope into operations, ensuring a fair marketplace. The question for investors becomes: Will valuations benefit from this decision?

Sum of The Parts

Management is looking to spin off the following businesses: China and International Commerce, Cainiao Logistics, Cloud Services, Digital Media & Entertainment, and Innovation Initiatives. Investors can find annual revenue figures for these respective businesses in the financial reports provided by Alibaba. These figures will be essential for figuring out the outstanding breakup value.

The sum-of-the-parts valuation method commonly used by investors and bankers consists of applying a valuation to the respective segments of a bigger company, adding them up, and analyzing the resulting value compared to the combined business value. In the case of the above businesses, most of them are in the "growth stage," meaning that net profits are unreliable or non-existent, except for the China and International Commerce businesses. Since investors cannot value based on income, revenue multiples will need to be implemented.

Taking the historical revenue growth of each individual business, investors can estimate what revenues will look like for 2023. Once revenues are estimated and projected based on sentiment and historical growth, price-to-sales multiples can be applied. For logistics, investors can compare these multiples against ZTO Express NYSE: ZTO and United Parcel Service NYSE: UPS. For commerce, EBAY NASDAQ: EBAY and Amazon NASDAQ: AMZN can be used, while for cloud and entertainment, Salesforce NYSE: CRM and Walt Disney NYSE: DIS are suitable subjects. Blending all of these price-to-sales multiples gives analysts a median range of 4.0x to 5.0x. Discounting brand name and geopolitical risks, a conservative 3.3x multiple can be applied.

This would effectively translate to a USD market capitalization of around $570 billion, or a per-share value of $180, right in line with the top estimates by analysts as they currently stand. It could be a sign of the times for investors to consider taking out their checkbooks as Dr. Burry did.

Before you consider Amazon.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amazon.com wasn't on the list.

While Amazon.com currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.