Eli Lilly and Company Today

LLY

Eli Lilly and Company

$830.57 +3.03 (+0.37%) As of 04/23/2025 03:59 PM Eastern

- 52-Week Range

- $677.09

▼

$972.53 - Dividend Yield

- 0.72%

- P/E Ratio

- 70.93

- Price Target

- $1,017.00

Global pharmaceutical giant Eli Lilly & Co. NYSE: LLY has made headlines with its leading GLP-1 weight loss drugs, Mounjaro and Zepbound. Mounjaro is prescribed for Type 2 diabetes but is often used off-label for weight loss. Zepbound is prescribed for obesity treatment. The active ingredient in both is Tirzepatide. Lilly submitted an application to the U.S. Food and Drug Administration (FDA) to expand the label for Zepbound to include treatment of obstructive sleep apnea (OSA) backed by its Phase 3 SURMOUNT-OSA clinical studies. OSA sufferers often use a continuous positive airway pressure (CPAP) machine to keep their airways open while they sleep to ensure they receive enough oxygen.

Eli Lilly’s List of Competitors Just Got Bigger

Eli Lilly and Company MarketRank™ Stock Analysis

- Overall MarketRank™

- 97th Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 22.4% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- Strong

- Environmental Score

- -2.25

- News Sentiment

- 1.01

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 32.54%

See Full AnalysisEli Lilly operates in the medical sector and competes with GLP-1 weight-loss medication providers and developers, including Novo Nordisk A/S NYSE: NVO, Viking Therapeutics Inc. NASDAQ: VKTX, and Altimmune Inc. NASDAQ: ALT. With its pending FDA application for OSA, ResMed Inc. NYSE: RMD and Inspire Medical Systems Inc. NYSE: INSP became the competitors, as evidenced by their 11.5% and 16% stock price drop, respectively, following news of Lilly’s trial results on June 21, 2024.

GLP-1 drugs were created to help Type 2 diabetes patients. A side effect was dramatic weight loss, especially among diabetes patients with obesity. Obesity has been linked to many health issues, including heart disease and stroke. Obesity can lead to OSA or worsen its symptoms.

Obstructive Sleep Apnea Impacts over 80 Million Americans

OSA is a breathing disorder experienced during sleep where the upper airway partially or completely collapses, resulting in apnea, decreased oxygen saturation, and waking up. The lack of efficient sleep can lead to more weight gain and other health issues. OSA impacts 80 million adults in the U.S., and over 20 million have moderate-to-severe OSA. OSA can lead to health problems, including hypertension, coronary heart disease, stroke, heart failure, atrial fibrillation, and Type 2 diabetes.

Eli Lilly Looks to Boost Zepbound Audience to Include Obstructive Sleep Apnea Patients

For this reason, GLP-1 drug makers are trying to expand their indications to broaden their user base suffering from health issues stemming from obesity. This has led Eli Lilly to study the effects of its GLP-1 obesity treatment, Zepbound (Tirzepatide), on obstructive sleep apnea. Eli Lilly conducted SURMOUNT-OSA phase 3 clinical trials on its impact on OSA.

The 52-week studies evaluated Tirzepatide injections in adults with moderate-to-severe OSA and obesity who were not on continuous positive airway pressure therapy (CPAP devices) and a second group of adults who were on CPAP devices. The apnea-hypopnea index (AHI) measures the number of times a person’s breathing is restricted or complete airflow blockage per hour of sleep. It’s used to determine the severity of OSA.

Zepbound Results in 55% AHI Reduction in OSA Patients without PAP Treatment

For the non-PAP patients, the Tirzepatide resulted in a mean AHI reduction from baseline of 27.4 events per hour compared to a mean AHI reduction from baseline of 4.8 events per hour with the placebo. Tirzepatide results in a 55% reduction versus 5% from baseline for placebo. It also led to a mean body weight reduction of 18.1% from baseline versus 3.1% for placebo.

Zepbound Results in 62.8% AHI Reduction for OSA Patients Using CPAP Machines

For the PAP patients, Tirzepatide led to a mean AHI reduction from a baseline of 30.4 events per hour compared to the mean AHI reduction from a baseline of 6 events per hour for the placebo. In key secondary outcomes, Tirzepatide resulted in a 62.8% AHI reduction compared to a 6.4% reduction for placebo in patients undergoing PAP therapy. They also had a mean bodyweight reduction of 20.1% from baseline compared to 2.3% for placebo.

The FDA Has Fast-Tracked a Decision on Zepbound Label Expansion to Include OSA

On June 24, 2024, Eli Lilly submitted an FDA application to expand the label for Zepbound to include treatment of OSA. The FDA has fast-tracked the application, leading to a quicker review process. Fast track is a designation for drugs that fill an unmet need or treat severe conditions. A decision from the FDA is expected by the end of 2024. This news sent shares of ResMed, the largest maker of CPAP machines, and Inspire Medical Systems plummeting over 10% each.

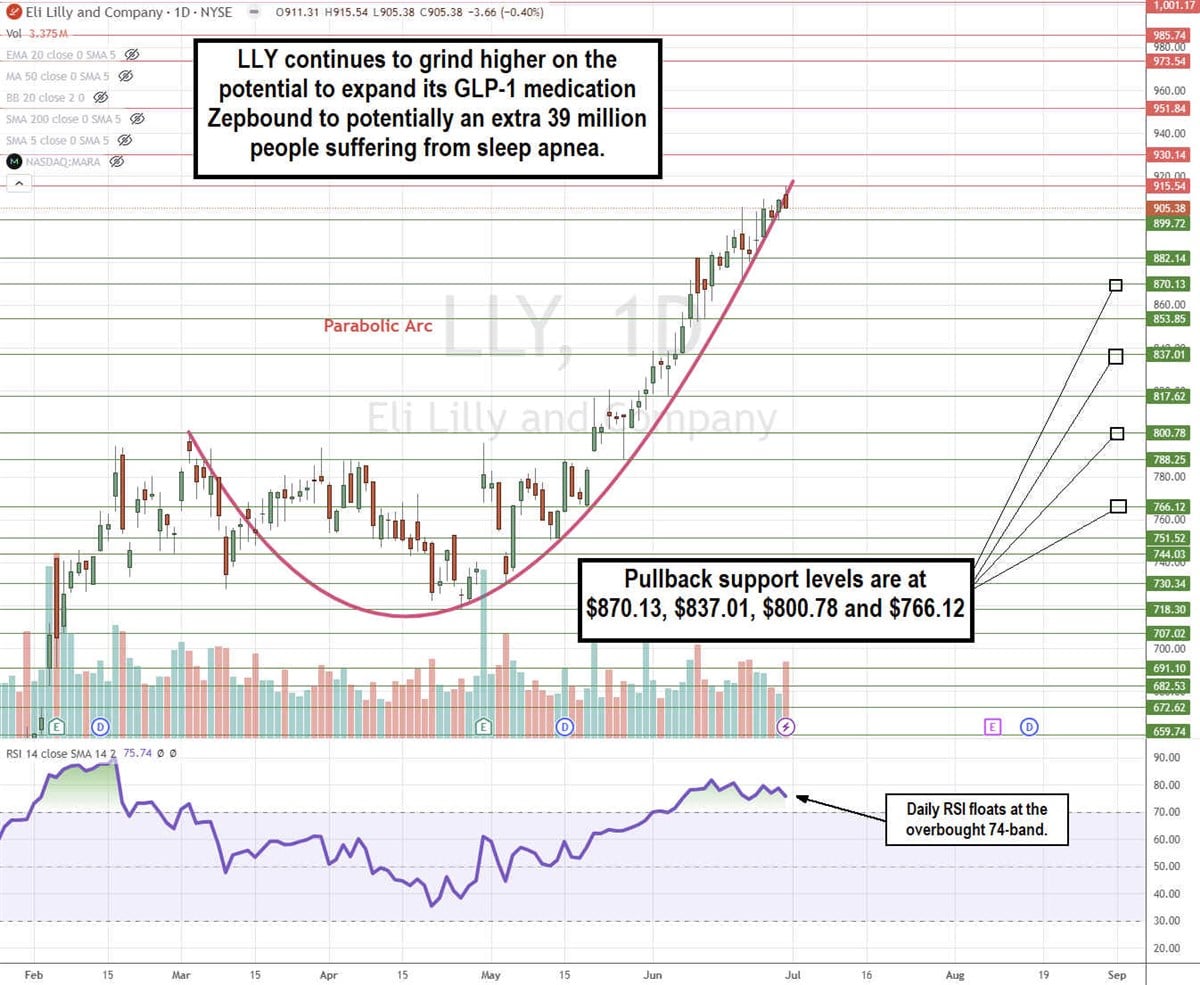

LLY Stock Continues its Parabolic Arc Pattern

The daily candlestick chart for LLY illustrates a parabolic arc pattern. LLY initially peaked at $800.78 on March 4, 2024. It formed a rounding bottom after hitting a low of $718.30 on April 25, 2024. Shares surged through the prior high to complete a cup pattern and continued to rise parabolically to new all-time highs on the run-up to $915.54.

Incidentally, the daily relative strength index surged up through the overbought 70-band on June 3, 2024, and it has been able to float above there ever since. Parabolic arc patterns are usually topping patterns, providing a buy-the-dip opportunity on the pullbacks as the RSI oscillates back down through the 70-band. The question is when, not if, it happens. Pullback support levels are at $870.13, $837.01, $800.78, and $766.12.

Eli Lilly & Co. analyst ratings and price targets are at MarketBeat.

Before you consider Eli Lilly and Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eli Lilly and Company wasn't on the list.

While Eli Lilly and Company currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.