The U.S. clean hydrogen sector is poised for a transformative expansion driven by favorable government policies, escalating demand for decarbonization solutions, and a growing recognition of the technology's potential to revolutionize energy production and consumption. While regulatory hurdles and certification standards still present challenges for companies operating in this space, a select group of innovators is well-positioned to capitalize on this emerging market.

Plug Power: A Fuel Cell Pioneer

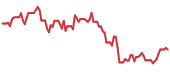

Plug Power Today

$2.27 -0.01 (-0.44%) (As of 10:01 AM ET)

- Price Target

- $5.19

Plug Power NASDAQ: PLUG is a frontrunner in fuel cell technology, and it is actively constructing green hydrogen production facilities and expanding its hydrogen refueling network. This strategic approach has propelled them to a leadership position in the clean hydrogen market. Their recent collaborations with major corporations, such as Walmart and Amazon, underscore the growing commercial interest in clean hydrogen solutions. These partnerships further validate the potential of this market and showcase the tangible impact of Plug Power's technology on real-world operations.

Plug Power's commitment to building a green hydrogen highway across North America and Europe underscores their ambitious vision for the future of energy. This initiative involves developing a network of fueling stations and hydrogen production facilities designed to meet the growing demand for clean energy solutions across various industries.

Plug Power Stock Forecast Today

12-Month Stock Price Forecast:$5.19127.57% UpsideHoldBased on 27 Analyst Ratings | High Forecast | $18.00 |

|---|

| Average Forecast | $5.19 |

|---|

| Low Forecast | $2.00 |

|---|

Plug Power Stock Forecast DetailsTheir strategy is further supported by their Gigafactory, a state-of-the-art facility for producing electrolyzers and fuel cells, which ensures a consistent supply of critical components for their hydrogen solutions.

Plug Power's earnings report for the second quarter of 2024 reflects its ongoing growth strategy. Revenue reached $143.4 million, driven by increasing electrolyzer deployments and improved pricing for fuel and other product lines. While the company reported a net loss of $262.3 million, this was attributed to strategic investments, market dynamics, and non-cash charges, including depreciation and amortization, stock-based compensation, and impairment charges.

Despite these headwinds, Plug Power is poised for continued growth. It plans to deploy an additional 100 MW of electrolyzers by the end of the year. This expansion and its commitment to building a robust green hydrogen infrastructure position Plug Power to remain a key player in this rapidly evolving market.

Bloom Energy: A Solid Oxide Fuel Cell Powerhouse

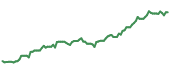

Bloom Energy Today

BE

Bloom Energy

$10.52 -0.18 (-1.68%) (As of 10:03 AM ET)

- 52-Week Range

- $8.41

▼

$18.14 - Price Target

- $15.88

Bloom Energy NYSE: BE is known for its solid oxide fuel cell technology, and it is leveraging its expertise to produce clean hydrogen through electrolysis. Bloom’s innovative approach to hydrogen production focuses on reducing costs and improving efficiency, making it a strong contender in the clean hydrogen market. Bloom Energy's solid oxide fuel cells offer a unique advantage by utilizing multiple fuel sources, including natural gas, biogas, and renewable fuels. This flexibility positions them well to address the diverse needs of customers across various industries.

Bloom Energy's financial performance reflects the company’s commitment to cost reduction and efficiency. Revenue for the second quarter of 2024 reached $335.8 million, marking an 11.5% year-over-year increase. Their non-GAAP gross margin also improved, reaching 21.8%, an increase of 1.4 percentage points year-over-year.

Bloom Energy Stock Forecast Today

12-Month Stock Price Forecast:$15.8848.36% UpsideHoldBased on 20 Analyst Ratings | High Forecast | $23.00 |

|---|

| Average Forecast | $15.88 |

|---|

| Low Forecast | $9.00 |

|---|

Bloom Energy Stock Forecast DetailsThis positive performance underscores their success in leveraging technology to drive efficiency and profitability. Bloom Energy's non-GAAP operating loss for the quarter was $3.2 million, a significant improvement compared to the previous year. This indicates their ongoing efforts to optimize operations and reduce costs.

Bloom Energy's commitment to innovation and collaboration is further highlighted by its partnership with CoreWeave, a leader in artificial intelligence (AI), to power a high-performance data center in Volo, Illinois. This agreement demonstrates their ability to provide clean energy solutions for demanding applications. Additionally, their agreement with Silicon Valley Power to provide power using Bloom fuel cells to power 20 megawatts of AWS data centers in Santa Clara, CA, showcases their commitment to expanding their reach in the data center market.

NextEra Energy: A Renewable Energy Giant Embraces Hydrogen

NextEra Energy Today

NEE

NextEra Energy

$84.39 -0.15 (-0.18%) (As of 10:04 AM ET)

- 52-Week Range

- $47.15

▼

$85.56 - Dividend Yield

- 2.44%

- P/E Ratio

- 22.99

- Price Target

- $82.07

NextEra Energy NYSE: NEE is a renewable energy giant making significant investments in green hydrogen production and aiming to become a major player in this emerging sector. Their vast experience developing and operating renewable energy projects gives them a competitive advantage in scaling up clean hydrogen production. NextEra Energy is actively pursuing opportunities to leverage its expertise and infrastructure to create a more sustainable energy future. They also benefit from the regulatory tailwinds that favor adopting clean hydrogen solutions.

NextEra Energy's financial performance reflects its commitment to growth and innovation. Their second-quarter 2024 net income attributable to NextEra Energy on a GAAP basis reached $1.622 billion, or $0.79 per share, while adjusted earnings for the quarter were $1.968 billion, or $0.96 per share.

NextEra Energy Stock Forecast Today

12-Month Stock Price Forecast:$82.07-2.93% DownsideModerate BuyBased on 16 Analyst Ratings | High Forecast | $102.00 |

|---|

| Average Forecast | $82.07 |

|---|

| Low Forecast | $60.00 |

|---|

NextEra Energy Stock Forecast DetailsThis strong performance highlights their ability to generate substantial revenue from their renewable energy assets and to manage costs effectively. The regulatory capital employed also saw significant growth, increasing by approximately 10.7% year-over-year, reflecting their ongoing investments in their infrastructure and operations.

NextEra Energy's subsidiary, NextEra Energy Resources, is actively pursuing opportunities in the clean hydrogen sector. Their second-quarter 2024 GAAP net income attributable to NextEra Energy reached $552 million, or $0.27 per share, compared to $1.462 billion, or $0.72 per share, in the prior-year comparable quarter. Adjusted earnings for the quarter were $865 million, or $0.42 per share, compared to $781 million, or $0.39 per share, in the prior-year comparable quarter. NextEra Energy Resources added over 3,000 megawatts (MW) to its backlog, totaling roughly 22.6 gigawatts. This expansion reinforces their commitment to becoming a leader in the clean hydrogen sector.

Investing in Clean Hydrogen

The clean hydrogen sector presents a compelling investment opportunity but has challenges. Investors must carefully evaluate the risks and opportunities associated with this sector before making any investment decisions.

One of the critical factors to consider is the regulatory landscape. The development of clear and consistent regulations is crucial for the growth of the clean hydrogen sector. However, the current regulatory environment is still evolving, and the pace of change can be unpredictable. This uncertainty can create challenges for investors seeking to assess the long-term viability of companies operating in this sector.

Another key factor is the development of certification standards. Consistent and reliable certification standards are essential for ensuring the safety and performance of hydrogen production and storage technologies. The lack of established standards can create uncertainty for investors trying to assess the quality and reliability of hydrogen products.

The overall growth potential of the clean hydrogen sector is another factor to consider. The increasing demand for decarbonization solutions and the growing recognition of hydrogen's potential to revolutionize energy production and consumption are positive indicators for the future of this market. However, it is essential to recognize that the clean hydrogen sector is still in its early stages of development, and the pace of adoption may not be as rapid as some investors anticipate.

The clean hydrogen sector presents a compelling investment opportunity. Despite the regulatory challenges and uncertainties, the growing demand for clean energy solutions, coupled with technological advancements, suggests a bright future for this sector. As the regulatory landscape becomes clearer and certification standards improve, the U.S. clean hydrogen sector is set for substantial growth, presenting investors with opportunities in a rapidly evolving market. Investors willing to take a long-term view and carefully research the companies operating in this sector may be well-positioned to reap the rewards of this fledgling industry.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report