Hims & Hers Health Today

HIMS

Hims & Hers Health

$27.80 -0.14 (-0.49%) As of 01/17/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $8.14

▼

$35.02 - P/E Ratio

- 63.19

- Price Target

- $25.13

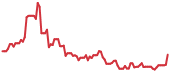

Hims & Hers Health Inc. NYSE: HIMS, a telehealth company with a $6.1 billion valuation, has been a remarkable growth story, especially over the past year. The stock climbed an astounding 215% in 2024, significantly outperforming the broader market and its sector. This momentum has carried into 2025, with shares already up over 15% already year-to-date.

Short-term traders might be closely watching for further upward momentum, with the stock now consolidating bullishly below its 52-week highs. However, as the company faces increasing challenges, including a stretched valuation and rising competition, investors are left to determine whether HIMS is better suited for momentum trading or long-term ownership.

2024: A Year of Exceptional Growth

The company’s success in 2024 was fueled by a combination of financial outperformance, subscriber growth, and innovation in its product offerings. Hims & Hers reported consistent revenue growth throughout the year, often exceeding Wall Street’s expectations. For example, in Q3 2024, revenue surged 77% year-over-year to $401.6 million, with adjusted EBITDA reaching $51.1 million, a clear sign of the company’s ability to scale efficiently. This strong financial performance was bolstered by significant subscriber growth, as the company expanded its base to 2 million, a 44% increase compared to the previous year. Personalized offerings became a major driver of retention and satisfaction, with over 40% of subscribers utilizing tailored solutions by year-end.

The introduction of GLP-1 weight loss drugs also contributed significantly to revenue growth, offering a new avenue for customer acquisition and engagement. However, even without this specific product line, Hims & Hers demonstrated the strength of its core business through impressive overall results. The company's ability to innovate while maintaining financial discipline allowed it to stand out in the competitive telehealth space.

Challenges Loom in 2025

Despite its strong growth trajectory, Hims & Hers faces several hurdles in the year ahead. A key concern is its reliance on compounded GLP-1 drugs, which have been in high demand due to their effectiveness in weight loss. While shortages of these medications allowed Hims & Hers to step in with compounded alternatives, FDA regulations only permit this practice during shortages. With the active ingredient, semaglutide, now listed as “available” across all doses, the opportunity to sell compounded versions may soon diminish. As manufacturers like Novo Nordisk ramp up production of branded drugs such as Ozempic and Wegovy, this revenue stream window could close entirely, creating uncertainty about its sustainability as a growth driver.

Competition in the telehealth space is another significant challenge. Amazon’s expansion into the sector through One Medical poses a direct threat, offering upfront pricing and convenience through Prime membership. This initiative adds pricing pressure and leverages Amazon’s logistical capabilities to capture market share. Meanwhile, competitors like Teladoc Health continue to vie for customers, intensifying the competitive landscape. For Hims & Hers to maintain its edge, it must focus on product differentiation, personalized care, and technological innovation.

Analyst Sentiment and Insider Activity

Hims & Hers Health Stock Forecast Today

12-Month Stock Price Forecast:$25.13-9.60% DownsideHoldBased on 17 Analyst Ratings | High Forecast | $42.00 |

|---|

| Average Forecast | $25.13 |

|---|

| Low Forecast | $10.00 |

|---|

Hims & Hers Health Stock Forecast DetailsShifting sentiment among analysts and insiders reflects the growing challenges. Over the past year, the consensus analyst rating has moved from a Moderate Buy to a Hold, with a price target forecasting approximately 10% downside from recent levels. Analysts at Citi recently downgraded the stock on valuation concerns, specifically relating to the company's GLP-1 revenue stream. Citi analysts noted that the potential removal of Semaglutide from the FDA's shortage list within 12 months could significantly constrain the company's weight loss business and reduce its 2025 GLP-1 revenue estimate from $400 million to $135 million. Additionally, Citi noted increasing competition from major pharmaceutical companies.

Institutional sentiment has also been tepid, with $70 million in net outflows over the last twelve months. Insider activity adds another layer of caution, with insiders selling $70 million worth of shares versus just $2 million in purchases during the same period. These signals suggest a more cautious outlook despite the company’s strong fundamentals.

Momentum Play or Long-Term Investment?

Hims & Hers remains well-positioned for short-term traders looking to capitalize on its current uptrend. A breakout above $28 could potentially lead to a rally toward the $30s, near the stock’s 52-week high. However, the challenges posed by regulatory risks and heightened competition make its long-term outlook less confident at current valuations. For now, the stock appears more suitable for momentum trading than for long-term ownership, with the latter requiring more apparent growth prospects and resolution of regulatory uncertainties.

Before you consider Hims & Hers Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hims & Hers Health wasn't on the list.

While Hims & Hers Health currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.