Most investors have had to worry about the accelerating sell-offs happening across the global stock markets this week, which aren’t being encouraged by news from Warren Buffett’s latest decisions. The Oracle decided to start decreasing its exposure to some of America’s technology darlings, such as Apple Inc. NASDAQ: AAPL, which was cut by 50%, or Bank of America Co. NYSE: BAC.

HIMS

Hims & Hers Health

$13.97 +0.32 (+2.34%) (As of 04:16 PM ET)

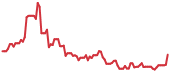

- 52-Week Range

- $5.65

▼

$25.74 - Price Target

- $20.29

Even a few months ago, investors received a warning from Stanley Druckenmiller after he sold out of NVIDIA Co. NASDAQ: NVDA to reallocate into bonds and small-cap stocks. Some investors may have benefited from copying his liking of the iShares 20+ Year Treasury Bond ETF NASDAQ: TLT, but these have now become too famous a pick to follow up on.

What is still—arguably—undervalued and poised to rally in the coming months is a little-known healthcare stock called Hims & Hers Health Inc. NYSE: HIMS. Bringing the stability and predictability that come from investing in a defensive space like health care, along with the exciting and promising growth potential that technology offers, this company just proved to the market that an S&P 500 sell-off is nothing compared to the growth it delivered in its latest quarterly results.

Hims & Hers Stock: Double-Digit Crash Turns Into Double-Digit Beat

Over the past few weeks, bearish action has taken hold of Hims & Hers stock, but it has nothing to do with the company’s prospects at all.

After posting disappointing demand guidance for its weight loss and diabetes watch medical devices, shares of DexCom Inc. NASDAQ: DXCM brought down all other stocks associated with weight loss products.

The main difference is in the word devices; Hims & Hers doesn’t sell devices but instead sells medicine directly to aid in weight loss efforts. Secondly, according to its investor presentation, only one of ten product offerings must deal with weight loss.

Not only is weight loss a minuscule share of the company’s revenue, but it was only introduced in December of 2023, so the impact could not have been as significant as to send the stock trading as low as 68% of its 52-week high. Here’s what the actual results look like in support of a potential recovery rally.

Total subscribers grew 43% over the past 12 months for Hims & Hers. Subscriber growth is much different from monetizing these new members. Still, investors can rest assured that the company achieved this, as shown in the 52% jump in revenues over the year.

All told, one of the most critical metrics in any business also jumped up by triple-digits this time. Free cash flow (operating cash flow minus capital expenditures) is up to $53.6 million, or 377% on the year, and that is one of the main milestones investors look for when finding their next multi-bagger investment.

Wall Street Sees Significant Upside Potential in Hims & Hers Stock

Riding on this recent financial momentum, management felt comfortable guiding the rest of 2024 higher, and that is not only enough to send the stock into a recovery rally and makes it easier for Wall Street analysts to correctly value the stock today.

Those at Truist Financial see a price target of up to $23 a share for Hims & Hers stock, daring it to rally by 29% from where it trades today. To support these targets, the general forecast for up to 90% earnings per share (EPS) growth in the next 12 months is the foundation for bullish sentiment.

However, these analysts weren’t the only ones on Wall Street willing to publicize their bullish views. Those at the Vanguard Group, Hims & Hers’ largest shareholder, boosted their stakes in the company by 1% in the past quarter. This addition brought the asset manager’s net investment to $221.4 million today, or 6.7% ownership in the company.

One last check investors can review is by decrypting the market’s message. To do this, Hims & Hers stock should be compared to the rest of its peer group on a valuation basis. Where a positive outlier is found, that is typically bullish sentiment for the stock.

Regarding the price-to-book (P/B) ratio, Hims & Hers stock trades at an 11.1x multiple to command a premium valuation over the medical sector’s average 4.6x multiple today. Usually, there is an excellent reason for stocks to trade at a premium, and investors have more than one when looking at the recent financial momentum in Hims & Hers stock.

Before you consider DexCom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DexCom wasn't on the list.

While DexCom currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.