Jumia Technologies NYSE: JMIA stock is jumping, and the move is the start of a much larger rally that could last for decades. Today, Jumia is a small, African-based eCommerce portal. Over time, it will grow into a giant. African economies are projected to grow at a globe-leading average of 3.7% this year, accelerate to over 4.% next year, and sustain acceleration for the foreseeable future. Most nations are forecasted to grow faster than 5% this year and accelerate next, compounded by a rapidly growing middle class. East African nations are projected to grow the fastest, supported by the energy industry and easier access to global shipping lanes.

Jumia Technologies Today

JMIA

Jumia Technologies

$3.80 +0.16 (+4.40%) (As of 11/22/2024 ET)

- 52-Week Range

- $2.88

▼

$15.04 - Price Target

- $6.53

The middle class will drive consumption, and that is Jumia's opportunity. The long-term outlook for average African growth rivals India's, with low-end targets suggesting 60% growth by 2023 and the high-end over 100%. That’s why Benchmark initiated the stock at Buy. They believe Jumia Technologies is well-positioned to capture and serve unmet pent-up demand. In their view, African nations are amid a demographic transformation that can drive years, if not decades, of growth for this business.

Jumia Technologies Connects a Digitized Africa

Jumia Technologies is an end-to-end solution for African eCommerce. The company is the leading eCommerce platform on the continent, serving eleven nations and more in the works. The platform is akin to Amazon NASDAQ: AMZN, providing a marketplace for buyers and sellers to interact. The services include integrated logistics and payment processing, all aided by AI. Recent headlines include integrating Sprinklr technology into the operation and opening new warehouses in key locations.

Sprinklr uses AI to power its unified customer experience management platform. The platform allows Jumia sellers to interact with customers seamlessly across multiple social media and communication platforms. The technology streamlines operations and improves customer experience, which is critical to its growth. The new warehouses are larger, integrated distribution centers, allowing greater efficiency and scalability. The new warehouses are expected to improve delivery times and margins while facilitating growth.

The Q1 results highlight the opportunities and risks for this company. Q1 revenue is up 18.4% on an 11% increase in Marketplace revenue and a 29% gain in sales, but it is still only $48.9 million. With 1.26 billion people living on the continent, about 15% of the global population, there is quite an opportunity to grow, but it will take time. Among the risks is FX conversion. The company's growth and profitability were hurt by FX conversion, which shaved 3700 basis points off of the top-line advance. Debt and a strong dollar are hurting many African nations despite their economic development and are burdens not easily shed.

Jumia Technologies MarketRank™ Stock Analysis

- Overall MarketRank™

- 37th Percentile

- Analyst Rating

- Hold

- Upside/Downside

- 71.9% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- N/A

- Environmental Score

- N/A

- News Sentiment

- 0.44

- Insider Trading

- N/A

- Proj. Earnings Growth

- Growing

See Full AnalysisJumia is still in its cash-burning phase, but there is good news. The cash burn was better controlled in FQ1, resulting in positive cash flow from operations. The net loss shrank to less than $10 million, which could be sustained for about two years, and the outlook is for the burn to dwindle. Profits aren’t expected in 2025 but may come in 2026.

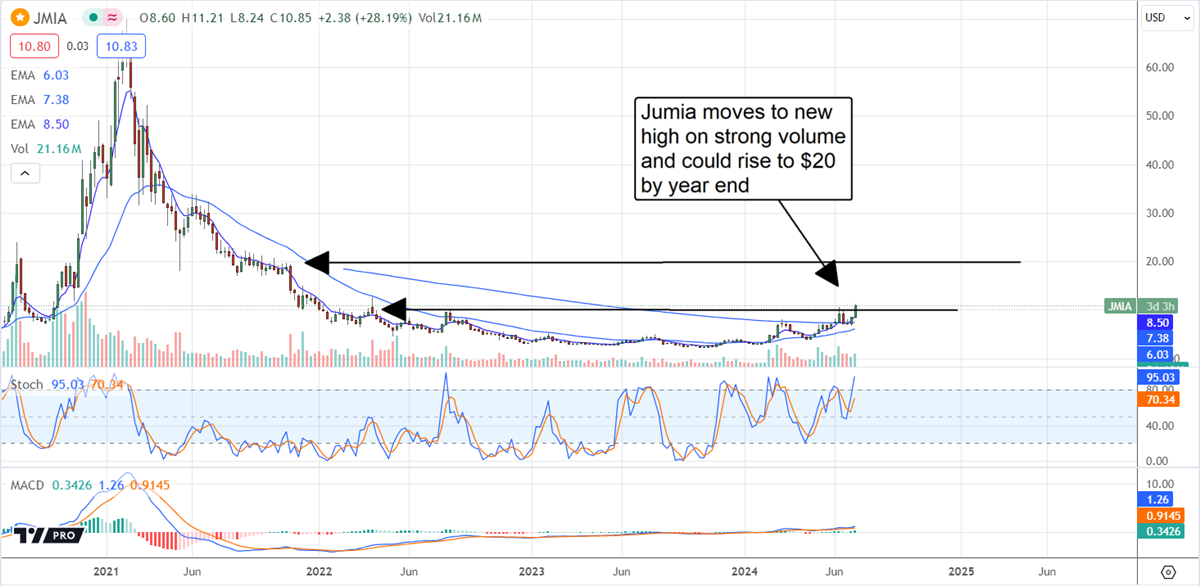

Analysts and Institutions Support This Rally

The 30% surge in Jumia stock is significant because it broke above critical resistance. This move suggests a more substantial rally will follow, and a move to Benchmark’s $14 target is probable. A move above that level may depend on the institutions, but the data is favorable. Institutions sold the stock earlier in the year but bought on balance in Q2. If that trend continues, the stock could easily surpass $15 by year’s end as it moves up to the $20 level, the next target for critical resistance. The FQ2 results are due in early August and may provide the catalyst.

Before you consider Jumia Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jumia Technologies wasn't on the list.

While Jumia Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.