Lyft Today

$13.57 -0.01 (-0.07%) (As of 12/20/2024 05:45 PM ET)

- 52-Week Range

- $8.93

▼

$20.82 - Price Target

- $17.77

Rideshare operator Lyft Inc. NASDAQ: LYFT made bold 2027 growth projections for its Investor Day, which caused shares to gap up to $17.29 initially but failed to sustain the move. The number two rideshare provider in the country is trying to close the gap with its number one competitor, Uber Technologies Inc. NYSE: UBER. Both computer and technology sector companies have turned profitable on an adjusted basis. The duopoly dominates the rideshare industry, with UBER holding a 76% market share in the United States.

Lyft Looks to the Future

On June 6, 2024, Lyft provided financial targets for 2027 while reaffirming its 2024 guidance for its Investor Day. The company expects gross bookings to have a compound annual growth rate (CAGR) of 15% from 2024 to the full year 2027. Adjusted EBITDA margin, measured as a percentage of gross bookings, is expected to be around 4% in 2027. Free cash flow conversion, measured as a percentage of adjusted EBITDA, is expected to be higher than 90% annually between 2025 and 2027.

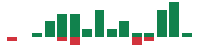

LYFT is Having Trouble Breaking Out of the Daily Descending Triangle

The daily candlestick chart on LYFT shows a descending triangle pattern. The descending trendline formed at the $20.82 peak and has capped each bounce attempt at lower highs connecting to the flat-bottom lower trendline at $15.27. The Investor Day financial update with 2027 targets helped to gap the shares, but they soon crapped back down into the triangle range again. The daily relative strength index (RSI) is stalled at the 42-band. Pullback support levels are at $14.90, $13.37, $12.21, and $11.36.

Lyft Reports a Solid Q1 2024 Earnings Report

On May 7, 2024, Lyft reported a Q1 2024 EPS of 15 cents versus 6 cents consensus estimates, beating by 9 cents. Net loss was $31.5 million compared to $187.6 million in the year-ago period. Net loss included $78.5 million in stock-based compensation and payroll tax expense. Gross bookings rose 21% YoY, ahead of its guidance of $3.5 billion to $3.6 billion. Adjusted EBITDA was $59.4 million, compared with $22.7 million in the year-ago period and above its $50 million to $55 million previous guidance. Lyft provided 188 million rides in the quarter, up 23% YoY. Active riders rose 12% YoY to 12.9 million, indicating improvement in rider retention.

Lyft Drivers Receive at Least 70% of Rider Fares

Lyft assured drivers they would receive at least 70% of the rider fare each week after external fees. The program launched in February and is having positive impacts. Nearly 75% of its drivers confirmed they now have a better understanding of their earnings.

Lyft's Women+ Connect Ride Feature

Lyft's Women+ Connect ride rollout received extremely positive feedback. This program enables female passengers to request female drivers. Women and non-binary activations increased 24% YoY. This continues to be one of the company's most successful initiatives.

Lyft's Positive Cash Flow Forecast for 2024

Lyft provided guidance for Q2 gross bookings of $4 billion to $4.1 billion. Adjusted EBITDA is expected to be between $95 million and $100 million, and an adjusted EBITDA of approximately 2.4%. Full-year 2024 ride growth is expected in the mid-teens, with gross bookings slightly higher than rides YoY growth. Full-year adjusted margins are expected to be around 2.1%. The company is on track to generate positive cash flow for the entire year. They expected 70% of adjusted EBITDA to convert to free cash flow for the full year 2024.

Lyft’s Advertising Business is Growing

Lyft Media revenues grew 250% YoY, with 50% of its business coming from repeat customers like Comcast Co. NASDAQ: CMCSA NBCUniversal. New customers added in the quarter include Zillow Group Inc. NASDAQ: ZG and Mastercard Inc. NYSE: MA.

Lyft CEO David Risher commented, “According to our third-party brand measurement firm, Lyft Media ad campaigns have 7 times the impact relative to the norm, on-brand perception, and purchase intent.

Lyft MarketRank™ Stock Analysis

- Overall MarketRank™

- 94th Percentile

- Analyst Rating

- Hold

- Upside/Downside

- 31.0% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- N/A

- Environmental Score

- -0.37

- News Sentiment

- -0.17

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 112.50%

See Full AnalysisOur video ads, which were new this quarter, also generated more than 10 times the ad industry's typical click-through rate. And in Q1, we added new partners, including Nielsen and Oracle Advertising, for their ad measurement and data enrichment solution for targeting, helping us deliver even more value for our customers.”

Lyft Gets 4 Upgrades After Investor Day

On June 7, 2024, Lyft received upgrades from four different analysts. Bank of America Securities, Gordon Haskett, and Loop Capital all upgraded their ratings to a Buy, with a price target of $20. Fox Advisors upgraded shares to Overweight from Equal Weight.

Lyft analyst ratings and price targets are on MarketBeat.

Before you consider Lyft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lyft wasn't on the list.

While Lyft currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.