According to Marketbeat.com’s analyst tracking tools, the most upgraded stocks in May are NVIDIA NASDAQ: NVDA, Palo Alto Networks NASDAQ: PANW, and Salesforce.com NASDAQ: CRM. The single unifying factor with all of these names is AI, which led to market-beating performance and increased guidance. Today's takeaway is that analysts are cheering the news and raising their targets and ratings, which is a tailwind for higher share prices.

NVIDIA Has a Game-Changing Quarter

NVIDIA reported one of the most stunning quarters on record. The company’s performance in Q1 isn’t the news; it’s the guidance for Q2, which was 50% better than expected. The shift to AI drives demand for its data-center products and will sustain a higher level of business for many quarters, if not several years. Regarding the analysts, 28 of the 37 covering the stock with current ratings tracked by Marketbeat raised their price target following the news. And not just a little. The consensus price target is up 41% compared to 30 days ago and will likely increase.

The only negative in the outlook now is the consensus figure. The consensus figure assumes the market trades at fair value with shares near $395. This could cap gains in the near term while the market digests the news and accepts the new paradigm. The upshot is that most new targets are above the consensus and in the $450 to $500 range, implying that at least 14% of upside is still available. Assuming the next quarterly report is as impressive as the current, this stock could rise into that range.

Palo Alto Networks: The Leader In Cloud-Based, AI-Powered Security

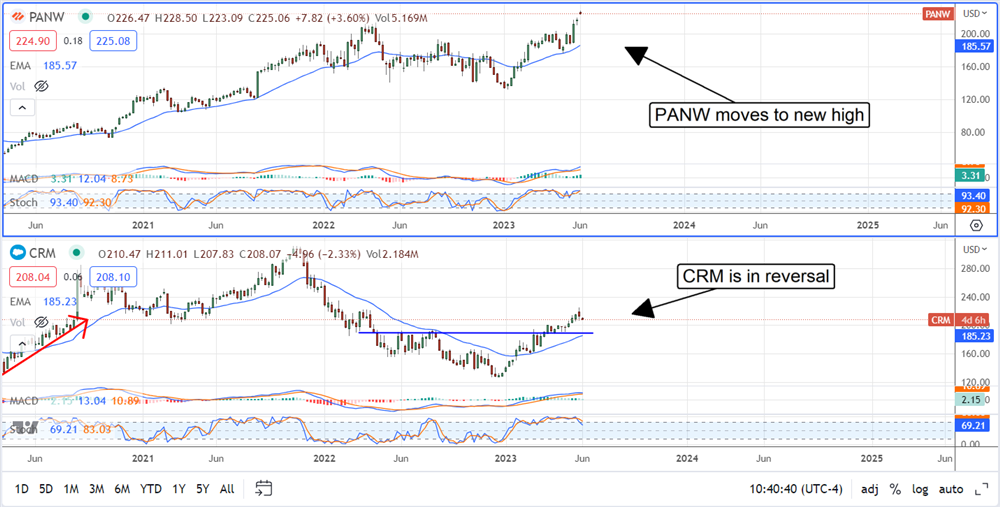

Palo Alto Networks was in rally mode before the FQ3 2023 results were released, which is supercharged now. The company issued a mixed report with revenue as expected and earnings above consensus; the margin improvement and guidance for Q4 moved the market. The news proves that company efforts are on track and has the company in a position for solid performance in 2024.

That’s why 22 of the 41 analysts rating Palo Alto Networks updated their price targets following the release. All included a price target increase, with the consensus trending higher and on the verge of a new high. The rating is Moderate Buy; the only downside is that the consensus target assumes the stock is fairly valued near $225 but is trending higher. The latest targets are mostly above the consensus, including several at $265, a gain of 17% from $225.

Palo Alto Networks has the bonus of inclusion in the S&P 500. The stock will be added to the index on 6/9 and replace Dish Network. This is part of the quarterly rebalancing process and will lead to index-buying in Juniper shares.

Salesforce.com: Buying On The Dip

Shares of Salesforce.com fell in the wake of its earnings release, but the analysts and the market bought it on the dip. The news sparked some mixed activity from the analysts but only 1 of 18 post-release updates was negative, and the rest increased their price targets. As it is, 39 analysts are rating this stock at Moderate Buy with a price target that has begun to move higher. The consensus moved above $220 to $225, which is important. The $225 level is a new 12-month high and would confirm a reversal in this market.

Before you consider NVIDIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVIDIA wasn't on the list.

While NVIDIA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.