Eli Lilly and Co. NYSE: LLY reported strong Q1 2024 earnings, causing shares to soar towards all-time highs initially, but a sell-the-news reaction triggered in the following days. The medical sector biopharmaceutical giant continues to gain from the GLP-1 drug weight loss trend that's taken the mainstream by storm.

The momentum for GLP-1 drugs shows no sign of slowing down as demand continues to outstrip supply. Analysts were pleasantly surprised when Lilly raised full-year 2024 top and bottom line forecasts, alleviating supply concerns. Eli Lilly competes in the GLP-1 segment against Novo Nordisk A/S NYSE: NVO and Viking Therapeutics Inc. NASDAQ: VKTX.

Novo Nordisk Warns of Falling Prices for GLP-1 Drugs

A major reason that led to the sell-the-news reaction in Lilly stock stems from the statement by competitor Novo Nordisk that prices are dropping for its Wegovy medication. Novo Nordisk stated in a conference call that its Ozempic and Wegovy prices fell slightly lower in Q1 2024. This was attributed to higher volumes and increasing competition, which will lead to further price cuts this year. That news caused shares of Novo Nordisk and Eli Lilly to fall.

Taking Steps to Bolster Capacity

Eli Lilly and Company Today

LLY

Eli Lilly and Company

$767.76 +10.22 (+1.35%) (As of 12/20/2024 05:45 PM ET)

- 52-Week Range

- $567.02

▼

$972.53 - Dividend Yield

- 0.78%

- P/E Ratio

- 83.00

- Price Target

- $1,002.22

Demand for its Tirzepatide dual agonist GLP-1/GIP drugs is so scorching hot that they're hard to keep on the shelves. Capacity constraints are the only obstacle. To boost capacity, Lilly just broke ground on a new $2.5 billion manufacturing facility in Germany. It expects its North Carolina site to commence production at year's end.

Expanding Indications

As if demand wasn't strong enough, Lilly is trying to expand the potential patient base for its GLP-1 drugs by expanding its indications for Zepbound. Mounjaro is only approved for type 2 diabetes. Zepbound is approved for chronic weight management. Since obesity can lead to many other diseases, Zepbound may prove to be beneficial for additional indications. Zepbound is currently undergoing Phase 2 clinical trials for non-alcoholic steatohepatitis (NASH) and Phase 3 trials for obstructive sleep apnea. It's also being studied for slowing the progress of Parkinson's Disease. New GLP-1 data is expected to be ready in 2025.

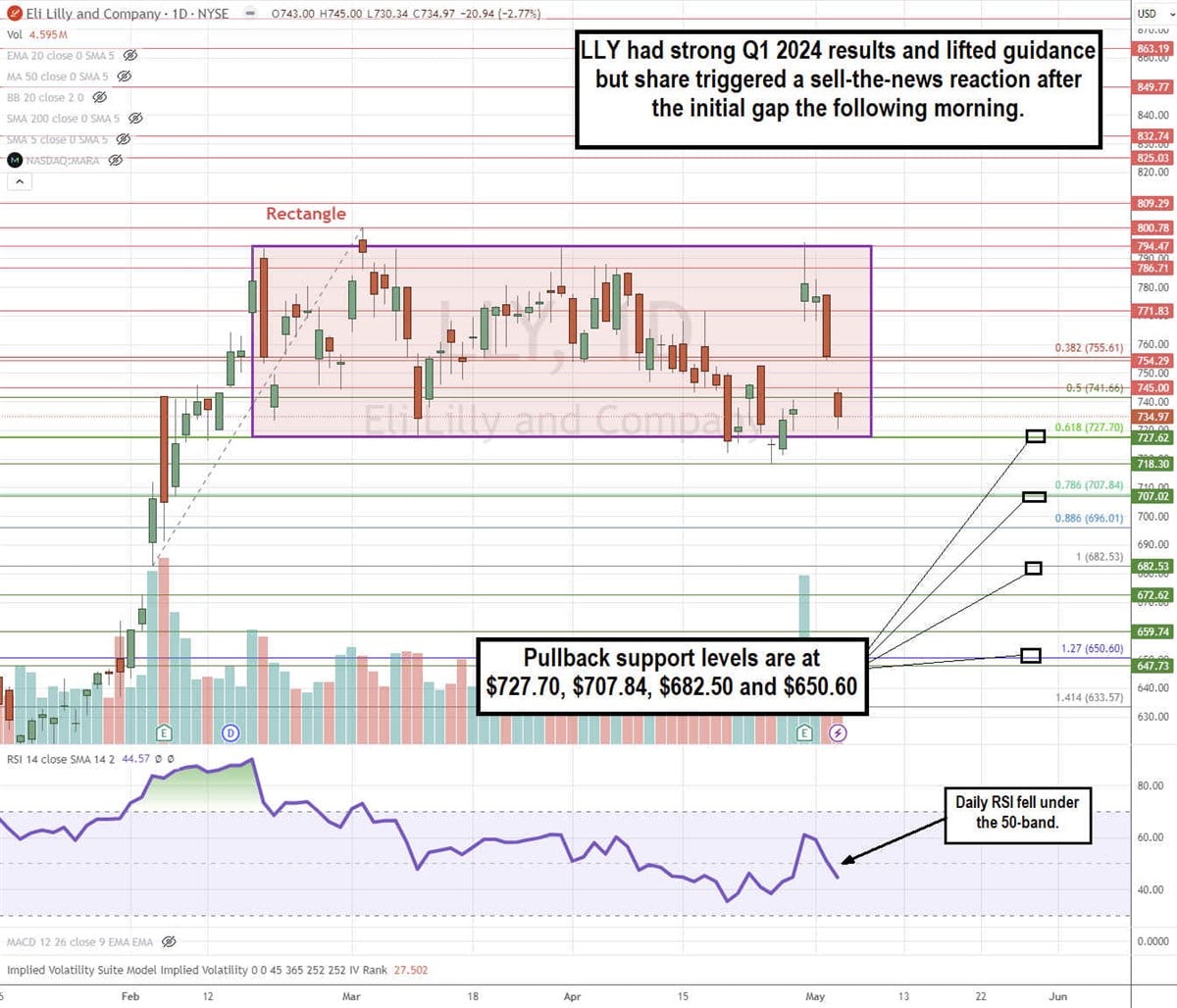

Daily Rectangle

LLY formed a daily rectangle pattern. The upper trendline resistance formed at $794.67 on February 16, 2024. It was rejected 5 times. The most recent was the breakout attempt after reporting its Q1 2024 earnings. The lower trendline support sits at the 0.618 Fibonacci (fib) retracement level at $727.70, which has held against 3 breakdown attempts. The daily relative strength index (RSI) has slipped under the 50-band. Pullback support levels are at $727.70, $707.84, $682.50 and $650.60.

Robust Q1 2024 Results

Lilly reported Q1 2024 EPS of $2.58, beating consensus analyst estimates by 11 cents. Revenues rose 26% YoY to $8.77 billion, falling short of $8.94 billion consensus estimates.

Top Drug Sellers

Revenues were driven by Mounjaro, Zepbound, Jardiance (cardiovascular and kidney disease) and Verzenio (breast cancer) treatments. Trulicity sales fell 26.3% YoY to $1.456 billion. Verzenio revenues rose 39.9% YoY to $1.05 billion. Mounjaro sales rose 217.8% YoY to $1.806 billion. Jardiance sales rose $18.9% YoY to $686.5 million.

Upside Guidance

Lilly raised full-year 2024 top and bottom line forecasts. Lilly expects 2024 EPS of $13.50 to $14.00, up from $12.20 to $12.70 versus $12.49 consensus estimates. Full-year 2024 revenues are expected to be between $42.4 billion and $43.6 billion, raised from $40.4 billion to $41.6 billion versus $41.44 billion.

Manufacturing Capacity Expansion Remains Top Priority

Eli Lilly CEO David Ricks stated its top priority is to execute its manufacturing expansion plans. The company will acquire a state-of-the-art facility from Nexus Pharmaceuticals in Prairie, Wisconsin. It's been FDA-approved, and initial production will commence by the end of 2025. The $2.5 billion parenteral manufacturing facility in Germany broke ground recently. The company is working to maximize production and productivity in all its existing facilities.

The EMA approval for its upcoming multi-dose KwikPen for Mounjaro delivery is expected to unlock new supply capacity in Europe and international markets. Ricks commented, "We continue to make progress against our plans to increase manufacturing capacity, the most ambitious expansion plan in our company's history."

Eli Lilly and Co. analyst ratings and price targets are on MarketBeat.

Before you consider Eli Lilly and Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eli Lilly and Company wasn't on the list.

While Eli Lilly and Company currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.