Internet-of-Things (IoT) technology provider Impinj Inc. NASDAQ: PI is riding a strong secular tailwind as the world continues to become more connected. The computer and technology sector leader manufacturers radio identification (RAIN) radio frequency identification (RFID) tag chips and provides a cloud connectivity platform. Its integrated circuit (IC) tags help retailers manage inventory supply chains and optimize inventory management, boost loss prevention and enable self-checkout. Impinj has over 305 IoT patents, has enabled the sale of over 44 billion items in 2023, and has shipped over 100 billion ICs as it seeks to expand the IoT to trillions of everyday items.

Some of its well-known clients range from retailers like Macy’s Inc. NYSE: M, Sephora, The Coca-Cola Co. NYSE: KO and The Home Depot Inc. NYSE: HD to logistics companies like United Parcel Service Inc. NYSE: UPS to manufacturers like The Boeing Co. NYSE: BA and Siemens AG OTCMKTS: SIEGY.

What Exactly Is the Internet of Things (IoT)?

While IoT is a common technology term these days, many people still don’t understand what it is and its significance. Chances are you’ve come in contact with the IoT every day and not realized it. The IoT is a network of connected devices that collect, share and upload data automatically via the tags or ICs attached to items like equipment, apparel, food, devices, machinery, pharmaceuticals, auto parts and everyday items. These items each have a unique identifier and the ability to seamlessly collect and transfer data autonomously without any human intervention.

These connected everyday items share data inside a larger ecosystem, the IoT. That data is analyzed using apps to improve efficiencies and monitor and optimize interactions. The devices most commonly used are RAID RFID tag chips that provide connectivity in real-time without barely any power consumption. The tags look like basic labels with barcodes that can be stuck on billions of items.

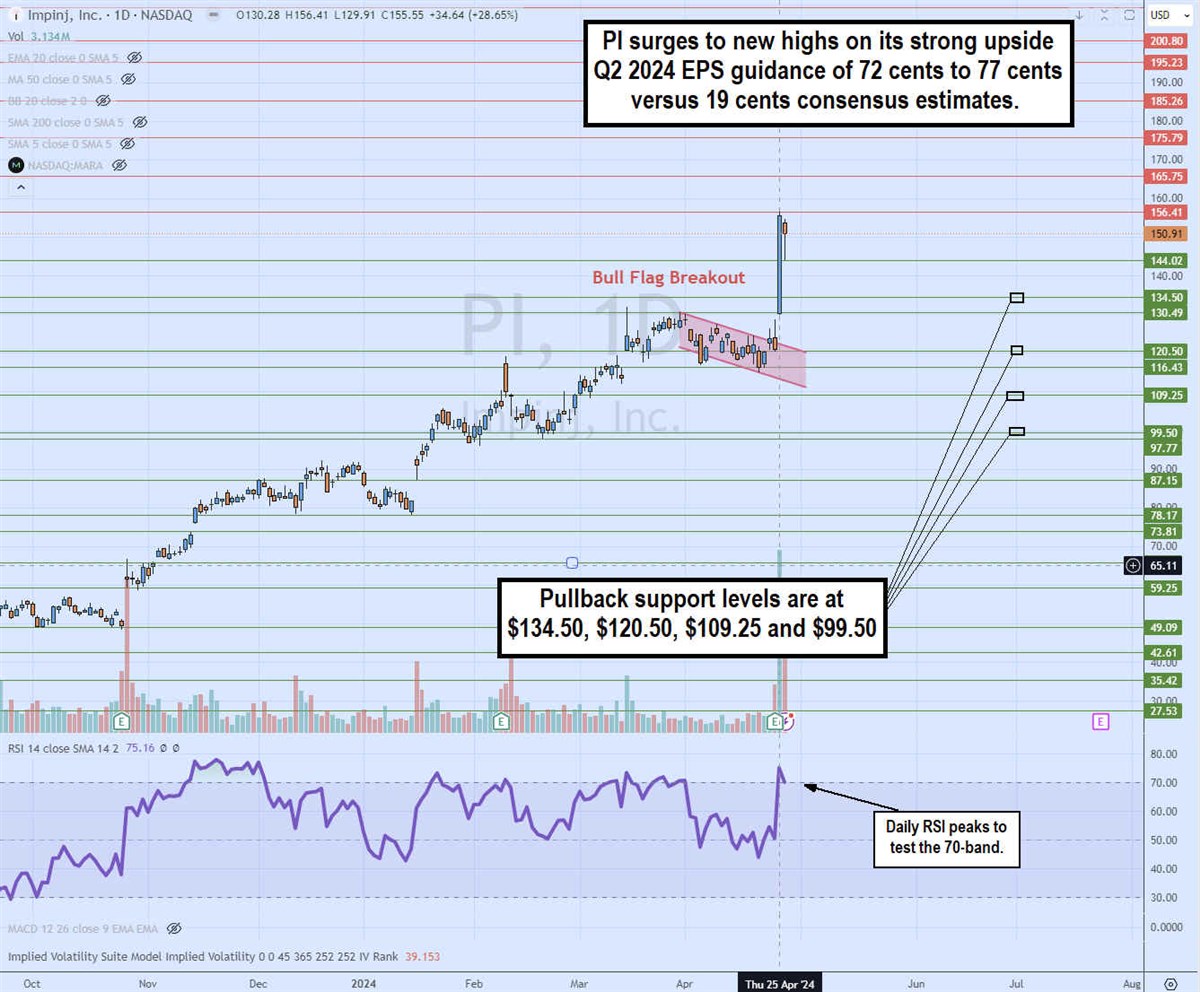

Daily Bull Flag Breakout

PI’s daily candlestick chart illustrates a bull flag breakout pattern triggered by its raised Q2 2024 guidance. The flag formed after the pole peaked at $130.49 on March 28, 2024. The flag formed on the parallel upper and lower trendlines, marking lower highs and lower lows. The breakout occurred on the earnings release as volume climbed over 3 million shares. The daily relative strength index (RSI) surged through the 70-band and has stalled on it. Pullback support levels are at $134.50, $120.50, $109.25 and $99.50.

Solid Q1 2024 EPS Beat

Impinj Today

$68.01 -0.01 (-0.01%) As of 12:13 PM Eastern

- 52-Week Range

- $60.85

▼

$239.88 - P/E Ratio

- 50.01

- Price Target

- $183.44

Impinj reported a modest Q1 2024 EPS of 21 cents, beating 10 cents analyst estimates by 11 cents. Revenues fell 10.6% YoY to 76.8 million, beating $73.58 million consensus estimates. The company has chipped over 100 billion ICs, connecting more than 4.5 million devices through more than 2000 partners. The growing demand for retail and general merchandise continued to accelerate into the new year. Retail apparel is its largest end market, generating 65% to 75% of its total revenues.

General Merchandise Category Drives Growth

Despite the slowdown in consumer spending and retail headwinds, Impinj is seeing continued acceleration in the retail space. They are also expanding into the much larger segment of general merchandise, which includes toys, stationary and electronics, as the company onboarded many new clients who are stamping RFID tags for the first time. The growth is expected to continue through the year.

Impinji Raises Q2 2024 Guidance

Impinj raised its Q2 2024 EPS guidance dramatically from 72 cents to 77 cents, blowing out the 19 cents consensus estimates. Revenues are expected between $96 million to $99 million versus $79.4 million consensus analyst estimates.

Momentum Expected to Accelerate in 2024

Impinj Co-Founder and CEO Chris Diorio credited Q1 2024 strength on its focus on silicon and enterprise solutions, which will pave the way for multi-year growth tailwinds. Impinj M800 tag chip volumes are expected to double in Q2 as production ramps up. Loss prevention and self-checkout solutions are performing nicely for a major European retailer and are expected to drive gateway demand through 2024. A large North American retailer's RAIN usage has accelerated thanks to additional products being tagged along with new products. Impinj expects the second large North American supply chain and logistics client to increase their label consumption in 2024.

Diorio concluded, “We see continued strength looking into the second quarter. Looking further out, we see growing opportunities to drive recurring licensing and services revenue, monetizing our IP, platform and cloud services. As we continue driving our bold vision to connect every item in our everyday world, I remain confident in our market position and energized by the opportunities ahead.”

Get Impinj analyst forecasts and price targets at MarketBeat.

Before you consider Impinj, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Impinj wasn't on the list.

While Impinj currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.