Walt Disney Today

$112.03 +0.66 (+0.59%) (As of 12/20/2024 05:45 PM ET)

- 52-Week Range

- $83.91

▼

$123.74 - Dividend Yield

- 0.89%

- P/E Ratio

- 41.34

- Price Target

- $123.58

Entertainment powerhouse The Walt Disney Co. NYSE: DIS has already had a drama-filled year. CEO Bob Iger had to fend off a proxy battle for board seats with billionaire activist investor Nelson Peltz and his Trian Fund. While the S&P 500 index has been rising 14% year-to-date (YTD), Disney shares have been selling off from a peak of $123.58 in April to $99.66 by June 14, 2024. While shares are still up 10% YTD, the stock has fallen over 19% since its peak.

Disney competes in the consumer discretionary sector with media and entertainment giants, including Comcast Co. NASDAQ: CMCSA, down 15%; Warner Bros. Discovery Inc. NASDAQ: WBD, down 36%; and Paramount Global NASDAQ: PARA which is down 29% YTD. Incidentally, Disney is outperforming its peer stocks, which are trading near their respective 52-week lows.

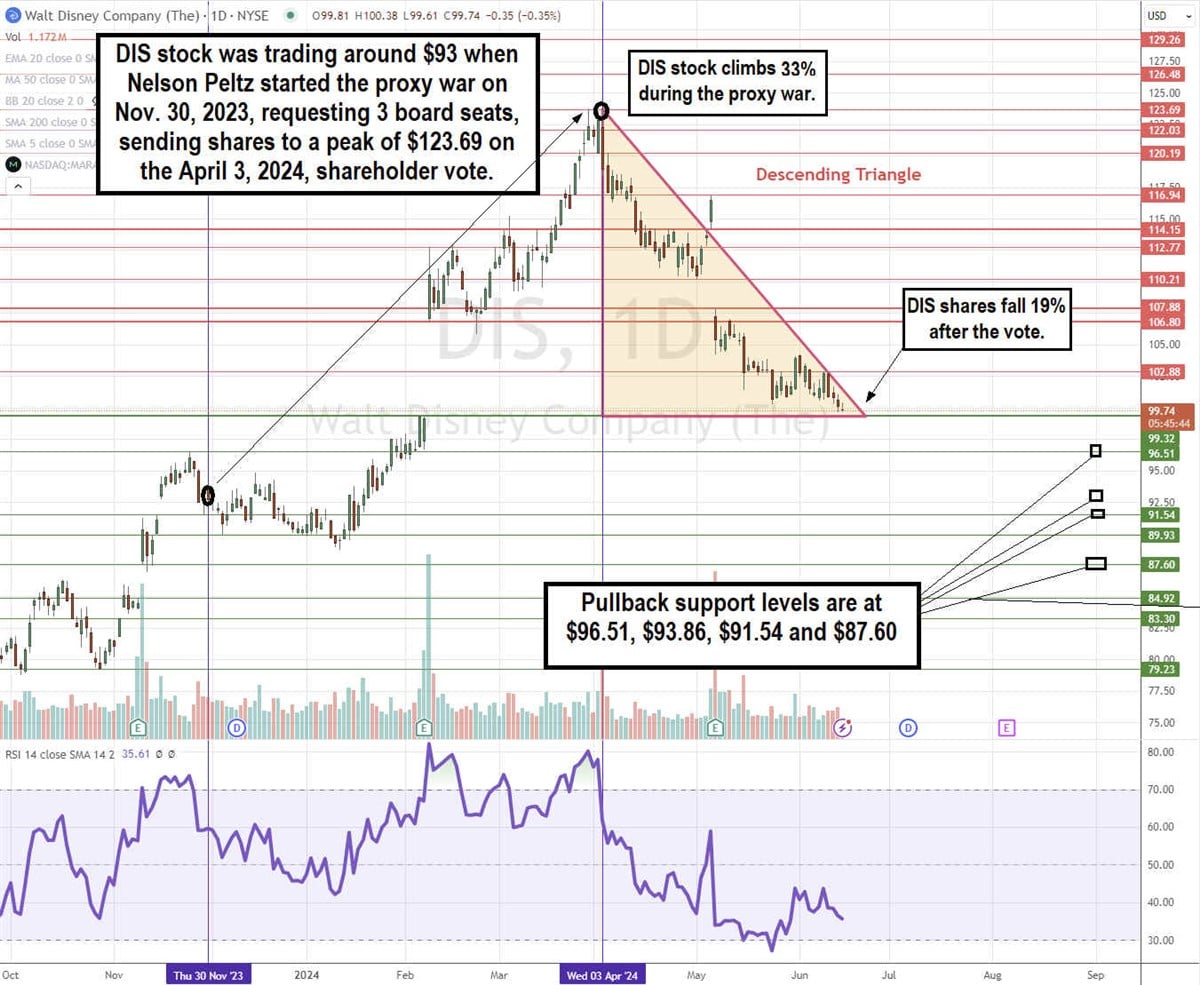

Walt Disney Stock Climbed 33% During the Proxy Battle

While CEO Bob Iger maintain the board seats and his position from winning the proxy fight, no one can deny the benefits the proxy battle did for shares leading up to the annual meeting and shareholder vote. Disney stock was languishing in the low $80s at the start of November 2023; These are share price levels that had not been seen since the pandemic lows of March 2020. On November 30, 2023, Nelson Peltz waged the ‘Restore the Magic’ proxy battle requesting three board seats, which kickstarted a 33% rally from $93.86 up to the $123.69 peak on April 3, 2024, during the shareholder vote.

Peltz Loses the Proxy Battle But Won Nearly $1 Billion in Profits

On May 29, 2024, CNBC reported that Nelson Peltz sold all his Disney stock around $120 per share, profiting nearly $1 billion. Disney shares have slid 19% from their $123.69 high to $99.66 on June 14, 2024.

Disney DTC Generates Profits Ahead of Schedule

Shareholders are now in for the ride. Prior to the proxy vote, CEO Iger made a bold forecast that the direct-to-consumer (DTC) entertainment division would be profitable in 2024. The DTC segment includes its streaming networks Disney+, Hulu, and Disney+ Hotstar, an Indian subscription streaming service. The DTC segment actually generated a $47 profit in Q2 2024, compared to a loss of $587 million in the year-ago period.

DIS Stock is in a Descending Triangle Pattern As It Falls to Critical Support

The daily candlestick chart on DIS illustrates a descending triangle pattern. This pattern is comprised of a descending (falling) trendline resistance that formed at the $123.69 high on April 3, 2024, capping bounces at lower higher. The flat-bottom lower horizontal trendline formed at $99.74, which is a critical support as it represents the gap fill on the February 7, 2024, earnings gap. DIS completed the gap fill; next, it will either bounce from here or trigger a descending triangle breakdown if shares fall under the lower trendline. The daily relative strength index (RSI) fell back under the 35-band. Pullback support levels are at $96.51, $93.86, $91.54, and $87.60.

Disney’s Scores a Profitable Quarter, But Shares Gap Down Anyways

On May 7, 2024, Disney reported its Q2 2024 adjusted EPS of $1.21, beating $1.10 consensus estimates by 11 cents. Revenues rose 1.2% YoY to $22.08 billion, missing $22.12 consensus analyst estimates. The company purchased $1 billion of stock in the quarter. Strength was attributed to its Experiences segment, which had 10% YoY revenue growth and 12% operating income growth, with 60 bps of margin expansion and streaming business. Sports operating income fell slightly from the year-ago period due to the timing impact of College Football Playoff games at ESPN.

True to CEO Iger's words, the DTC segment turned a profit. However, those expectations were already priced into the stock as a sell, and the new reactions took over.

Disney DTC Entertainment Segment Turns Profitable But Expects Softness in Q3 2024

The DTC segment generated $47 million in profits in Q2 2024. However, Q3 2024 is expected to be soft due to the integration of Disney+ Hotstar. This contributed to the stock's sell-off. Profits are on track to resume in Q4 2024. Disney+ Core subscribers grew by over 6 million in the quarter as average revenues per user (ARPU) increased by 44 cents.

Disney's Guidance was Reaffirmed for the Full Year 2024

Disney reaffirmed the full-year 2024 adjusted EPS growth to around 25% or $4.70 versus $4.71 consensus estimates. The company remains on track to generate nearly $14 billion of cash and more than $8 billion in free cash flow (FCF) in fiscal 2024.

Walt Disney MarketRank™ Stock Analysis

- Overall MarketRank™

- 98th Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 10.3% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- Weak

- Environmental Score

- -0.46

- News Sentiment

- 0.50

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 13.12%

See Full AnalysisCEO Iger commented, “Looking at our company as a whole, it’s clear that the turnaround and growth initiatives we set in motion last year have continued to yield positive results. We have a number of highly anticipated theatrical releases arriving over the next few months; our television shows are resonating with audiences and critics alike. “

He concluded, “ESPN continues to break ratings records as we further its evolution into the preeminent digital sports platform, and we are turbocharging growth in our Experiences business with a number of near- and long-term strategic investments.”

Disney analyst ratings and price targets are at MarketBeat. The consensus price target is $126.29, with a 26.34% upside.

Before you consider Walt Disney, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walt Disney wasn't on the list.

While Walt Disney currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.