Zoom Video Communications Inc. NASDAQ: ZM shares hit a new 52-week low despite improvements indicating normalization may be near completion in its business. Zoom stock was the darling of the pandemic era, surging to a high of $588.84 in October 2024 as the whole world went virtual during the global lockdowns. Zoom became a household name and even a verb to describe engaging in video conferences, visits and meetings. It’s become a permanent fixture in the remote and hybrid work segment. The macro market sell off has accelerated the selling in Zoom Video.

It’s evident that people are making fewer Zoom calls for social engagements, but the markets care more about whether normalization has concluded and growth resumes in the enterprise business segment. Investors are left to wonder if Zoom shares are getting too cheap to pass up.

Zoom competes with computer and technology sector giants like Microsoft Co. NASDAQ: MSFT Teams, Salesforce Inc. NYSE: CRM, and Adobe Inc. NASDAQ: ADBE.

The Evolution of AI Integration

Zoom is mainly known for its video conferencing app and software. What originally started as a video conferencing platform has evolved into a full communications and work collaboration ecosystem. Its Zoom Workplace is an AI-powered collaboration platform that includes meetings, team chat, a scheduler, a whiteboard and spaces. It formed a partnership with Avaya Holdings Co. NYSE: AVYA to integrate with its Communication & Collaboration Suite.

Virtual Agent is an AI-powered feature in its Contact Center offering. Virtual Agent has helped save over 400,000 agent hours per month. Generative AI is used to generate meeting notes, summaries and transcription services. Its AI also offers non-verbal cue detection and speaker identification.

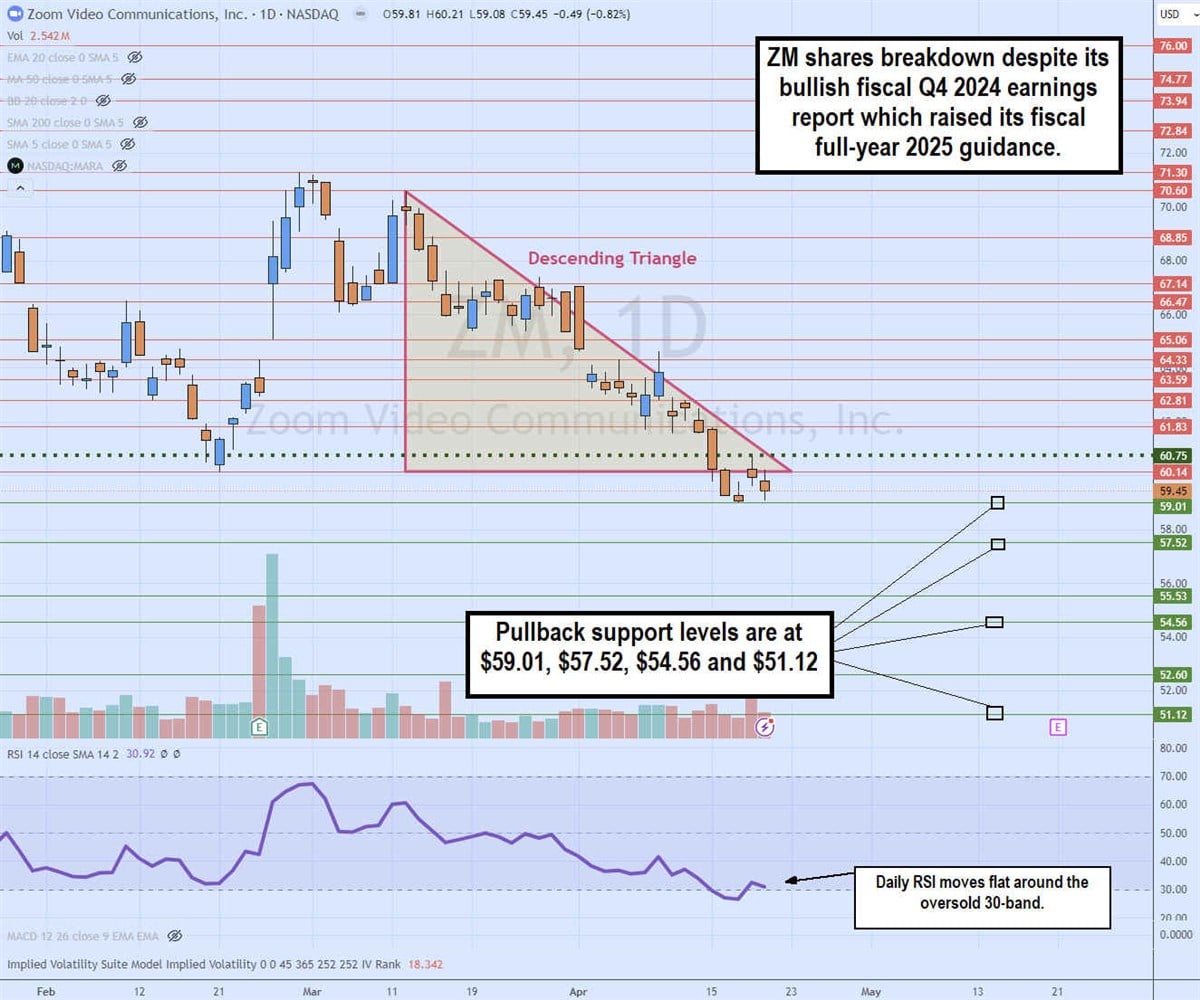

Daily Descending Triangle Pattern

ZM has a descending triangle breakout pattern on its daily candlestick chart. The daily descending trendline formed at $70.60 on March 12, 2024. The lower flat-bottom trendline is at $60.14. As shares approach the apex point, ZM is breaking down under the flat-bottom trendline. The daily market structure low (MSL) trigger forms a breakout through $60.75. The daily relative strength index (RSI) is flat around the 30-band. Pullback support levels are at $59.01, $57.52, $54.56 and $51.12.

Impressive Fiscal Q4 2024

Zoom Video Communications Today

ZM

Zoom Video Communications

$71.98 +0.64 (+0.90%) As of 04/14/2025 04:00 PM Eastern

- 52-Week Range

- $55.06

▼

$92.80 - P/E Ratio

- 23.99

- Price Target

- $89.33

The days of Zoom’s scorching hot 325% growth during the pandemic era are over. Investors will have to settle for the 2.6% YoY growth achieved in its fiscal Q4 2024. The $1.15 billion in revenues still beat consensus estimates for $1.13 billion. Zoom has returned to profitability. Its GAAP income rose to $168.5 million in the quarter compared to a loss of $129.9 million in the prior year quarter. The EPS performance of $1.42 beat consensus estimates by 27 cents.

The enterprise business rose 5% Year over Year in the quarter, bringing Zoom's year-end total of enterprise customers to 220,400. Customers with $100,000 or more in contract value rose 9.8% Year over Year to 3,810 in the quarter. Zoom closed the fiscal year with $7 billion in cash and cash equivalents, which is nearly 40% of its market capitalization. They also authorized a $1.5 billion stock buyback.

Raised EPS Estimates

Zoom Video lifted fiscal full-year 2025 EPS to $4.85 to $4.88, beating $4.66 consensus estimates. For fiscal Q1 2025, revenues are expected to be around $1.125 billion.

Growth in Phone

Zoom Video CFO Kelly Steckelberg noted its growth in Zoom Phone at the KeyBanc Emerging Technology Conference. Steckelberg commented, “And by the way, now with the advent of AI, like one of the features that you're going to get with Zoom AI companion is call summaries. So, if you're having a phone call, you can get a summary of that just like you can get a meeting summary. That innovation that's going to happen with AI is not going to be happening with those on-prem providers.

Rosenblatt Upgrade

On April 18, 2024, Rosenblatt Securities upgraded shares of Zoom Communications to a Buy from Neutral with a $75 price target. Analyst Catherine Trebnick noted that the upgrade considered a refocused channel strategy, momentum in the Zoom Phone and contact center-as-a-service (CCaaS) market, a healthy balance sheet and the $1.5 billion stock buyback.

Zoom Video Communications analyst ratings and price targets are at MarketBeat.

Before you consider Zoom Video Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zoom Video Communications wasn't on the list.

While Zoom Video Communications currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.