With Q4 2024 earnings reporting about wrapped up, the trends remain positive, although the outlook for 2025 earnings growth has dimmed. Stocks in leadership positions have begun to regain traction following respective price dips, suggesting the uptrend in the S&P 500 will continue if at a less robust pace than in 2024. This looks at five stocks poised for gains this year that investors should have on their watchlists for buying opportunities in March because they can outperform their peers and the broad market.

1) NVIDIA: Business Broadens as Automotive Demand Surges

NVIDIA Today

$101.33 -3.16 (-3.03%) As of 04/17/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $76.40

▼

$195.95 - Dividend Yield

- 0.04%

- P/E Ratio

- 39.88

- Price Target

- $165.51

There were many positives in NVIDIA’s NASDAQ: NVDA Q4 results and guidance for 2025, among them strength in the automotive segment. The automotive segment grew nearly 30% year-over-year in the quarter, driven by demand for driver-assist technology critical to advancing EVs and autonomous driving.

While still a small fraction of the company’s business, analysts view it as a potential billion-dollar revenue stream that will blossom over the next few years. That is good as it will help sustain growth and provide diversification away from the much stronger data center segment.

The analysts’ response to the news was mixed, including some downgrades and price target revisions, but overall bullish for the market. The consensus price target rose incrementally, indicating a nearly 30% upside, with another 30% possible at the high-end range. They rate the stock at a consensus of Moderate Buy, and the bias remains bullish, with 91% of the ratings at Buy or better.

2) Salesforce: Consensus Sentiment Firms, Forecasting 20% Upside

Salesforce Today

$246.93 -2.91 (-1.16%) As of 04/17/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $212.00

▼

$369.00 - Dividend Yield

- 0.67%

- P/E Ratio

- 40.61

- Price Target

- $360.32

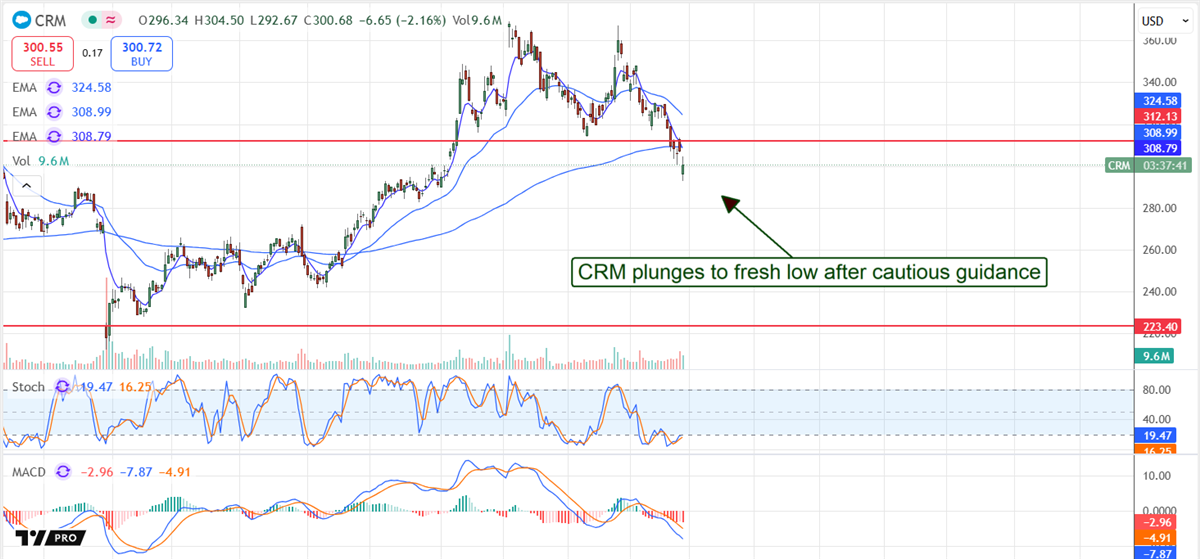

Salesforce NYSE: CRM issued a mixed earnings report and weak guidance that caused analysts to lower price targets. However, the takeaway from the data, the analysts’ chatter, and the new price targets is that business is good, the guidance is likely cautious, and the range of targets is tightening around the consensus estimate, about 20% above the critical support level.

Highlights from the report include high single-digit growth, substantial margin, and free cash flow sufficient to improve balance sheet metrics while returning capital to shareholders.

The capital return is significant, with dividends and buybacks annualizing to about 1.5% in 2024, the share count falling, and distribution increases expected annually.

3) 3M: A King Reclaiming Its Throne

3M Today

$130.16 -0.30 (-0.23%) As of 04/17/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $90.65

▼

$156.35 - Dividend Yield

- 2.24%

- P/E Ratio

- 17.24

- Price Target

- $146.47

3M NYSE: MMM is a former Dividend King forced to cut its distribution to right-size it following legal battles now behind it. The story in 2025 is that core businesses are good, cash flow is improving, and the capital return outlook is along with it.

The outlook for 2025 is for the company to revert to organic and adjusted growth, for the margin to widen, and for capital returns to grow. The capital return in 2025 includes a dividend that annualizes to 0.5% and share-count-reducing buybacks.

Analysts' trends are positive in 2025, including increased coverage, a firm sentiment pegged at Moderate Buy, and a rising consensus price target.

4) SoundHound AI: Price Pullback Presents Opportunity in Leading Technology

SoundHound AI Today

$7.84 +0.08 (+0.97%) As of 04/17/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $3.50

▼

$24.98 - Price Target

- $12.43

SoundHound AI’s NASDAQ: SOUN price pulled back to long-term lows following news that NVIDIA had sold its stake in the company. While bad news at first glance, the news does nothing to alter the company’s growth outlook, and the reason behind NVIDIA’s move is most likely innocuous.

The stock price gained more than 100% in the year NVIDIA owned it, presenting a compelling opportunity for it to take profits. The takeaway for investors is that SoundHound’s stock is trading at a multi-month low, with revenue growing at a hyper pace, business momentum growing, and outperformance likely relative to early 2025 estimates.

Analysts rate Soundhound as a Hold and see it advancing above $12.50, a 30% gain and possibly as high as $22.50 by the end of the year.

5) Shopify: The Most Upgraded Stock in February

Shopify Today

$83.65 -0.31 (-0.37%) As of 04/17/2025 04:00 PM Eastern

- 52-Week Range

- $48.56

▼

$129.38 - P/E Ratio

- 53.97

- Price Target

- $120.94

Shopify NYSE: SHOP is among the most upgraded stocks coming out of the Q4 reporting season and the most upgraded in February, receiving 22 positive mentions in under 30 days. The consensus is that this stock is a Moderate Buy with potential for at least 10% upside and more likely 20% or more by the year’s end.

The reason is that its eCommerce platform and services are easy to use, provide value to clients, and provide a pathway to improved sales and broader margins and a gateway to international business.

Results from Q4 included accelerated growth compared to the prior quarter and year, top and bottom line strength, and guidance for continued strength in 2025.

Before you consider NVIDIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVIDIA wasn't on the list.

While NVIDIA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.