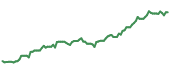

NextEra Energy NYSE: NEE is following the trend of strong performance amongst utility companies this year. Although its returns haven’t been as high-flying as others like Talen Energy NASDAQ: TLN the stock is still handily beating out the S&P 500, with a 39% total return. So, is this stock still a strong player going forward, or has it hit the end of the line for growth?

NextEra’s Business Segments and Energy Generation Breakdown: A Detailed Overview

NextEra Energy Today

NEE

NextEra Energy

$66.68 +2.00 (+3.09%) As of 04/22/2025 03:59 PM Eastern

- 52-Week Range

- $61.72

▼

$86.10 - Dividend Yield

- 3.39%

- P/E Ratio

- 19.79

- Price Target

- $84.46

One key difference between NextEra and a company like Talen is that it operates as both a rate-regulated utility company and sells energy in competitive markets. NextEra can't benefit as much from rising energy prices. But it has a stronger floor on how far its prices could drop. Its rate-regulated business comes mostly from its subsidiary, Florida Power & Light (FLP), Florida's largest electric utility. The actual energy generated for FPL in 2023 was 73% from natural gas and 20% from nuclear. FPL’s nuclear generation capacity is around 3.5 GW.

NextEra Energy Resources (NEER) focuses on renewable energy. It is the other part of NextEra's business. This part of the business operates in competitive markets. This subjects NEER’s business to more downside risk and upside opportunity based on changes in energy prices.

NextEra Energy Transmission (NEET) is also reported under NEER. NEET transmits energy from the FPL generation plants to the households and businesses that need it. As such, it is also subject to rate regulation. NEER’s actual generation was 66% from wind, 20% from nuclear, and 11% from solar. However, in terms of capacity, nuclear made up 7% and solar 19%. This shows that solar was relatively underutilized, largely in favor of nuclear.

NEER’s nuclear generation capacity is 2.2 GW, approximately the same size as Talen Energy’s nuclear capacity. It has contracted half of this 2.2 GWs through long-term purchase agreements while it sells the other half at prevailing market prices. NEER’s energy sales are diversified broadly across the United States and Canada.

NextEra posted another quarter of solid earnings on Oct. 23. It fell short of revenue estimates by around 6%, yet made up for it on earnings per share, posting a 6% positive surprise there. Overall, shares gained over 1% on the day. One positive point was that the company was able to restore power to 95% of Floridians affected by the recent hurricanes in just 2 to 4 days.

NextEra Has Both Nuclear and Renewable Tailwinds

Some key tailwinds exist for NextEra. First, it has a backlog of renewable energy projects totaling 24 GWs. This means that the company is working on projects that would nearly double NEER’s generation capacity. This demonstrates the massive demand for the segment's energy resources, and that the company is taking steps to meet it.

This differentiates the company from other firms like Talen and Constellation NASDAQ: CEG. Talen is looking to shut down several facilities and transition existing plants into other forms of energy generation. Constellation is increasing its capacity through recommissioning old nuclear sites like Three Mile Island. Markets saw this as a huge win for Constellation, and NextEra is considering the same thing.

NextEra Energy Stock Forecast Today

12-Month Stock Price Forecast:$84.4626.67% UpsideModerate BuyBased on 15 Analyst Ratings | Current Price | $66.68 |

|---|

| High Forecast | $102.00 |

|---|

| Average Forecast | $84.46 |

|---|

| Low Forecast | $71.00 |

|---|

NextEra Energy Stock Forecast DetailsThe company is considering reopening the Duane Arnold nuclear plant in Iowa due to interest from data center firms. This is similar to the Three Mile Island deal, which Constellation reached with Microsoft NASDAQ: MSFT to power its data center. Duane Arnold is capable of generating 601 MW of electricity, in which NextEra has a 70% interest.

Thus, if brought online, the Duane Arnold site would represent about half of the 835 MW capacity sold in the Three Mile Island deal. A deal would be less consequential than the Three Mile Island deal. However, it still provides significant upside to the stock. Given the demand for nuclear energy from data centers, I believe they will likely bring the plant online. Building new nuclear plants is costly and takes a long time. This would likely have a significant benefit for NextEra’s stock price.

The difficulty in building nuclear plants also makes the company’s large allocation to other renewable resources strongly beneficial. Unlike other firms that focus much more on nuclear energy like Constellation, NextEra can more easily expand its capacity to help meet electricity demand. According to Constellation, it expects U.S. electricity demand to rise by double the rate through 2030 compared to the previous decade. These tailwinds allow the company significant growth within energy and utility markets going forward.

Before you consider NextEra Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NextEra Energy wasn't on the list.

While NextEra Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.