Despite a strong start to the year, shares of tech titan Salesforce Inc. NYSE: CRM have been having a lackluster end to the summer. They gained 150% through the start of March before falling more than 30% in June due to some dodgy earnings.

Salesforce Today

$342.06 -2.37 (-0.69%) (As of 09:58 AM ET)

- 52-Week Range

- $212.00

▼

$369.00 - Dividend Yield

- 0.47%

- P/E Ratio

- 56.26

- Price Target

- $378.86

Since then, they’ve been working hard to reclaim their reputation as one of the hottest software stocks to own. As of Tuesday morning, they were up 20%. They still have a way to go before they’re within touching distance of March’s high, which might be frustrating for investors to swallow given the risk-on sentiment that’s been very much in control since November of last year.

This is likely to be especially so with the Fed having announced its intention to begin cutting rates, a policy move that should benefit growth-focused tech stocks like Salesforce more than most. But there’s an argument to be made that this has opened up an appealing entry opportunity to those of us still on the sidelines. Let’s take a look at some of the factors that make Salesforce a solid candidate heading into the final months of the year, and in particular, some of the upside calls the analysts are making.

Bullish Fundamentals: Salesforce Tops Expectations in Q2

For starters, let’s consider Salesforce’s Q2 earnings from last week. Salesforce managed to top analyst expectations for both headline earnings and revenue, which was called a “huge step forward” for the company.

While it was only the company’s third-highest EPS print ever, a little below last quarter and only $0.01 below the previous quarter, it was a new record for Salesforce’s quarterly revenue number. That’s not a bad headline to have come out after a couple of months where the stock has been underwhelming compared to its peers.

Why Analysts Are Doubling Down on Salesforce's AI Leadership

For the most part, the analysts loved it and spent no time hesitating before rushing in to call the stock a screaming buy. This should be of particular interest to investors considering refreshing their portfolios as we begin turning the corner into the year's final quarter.

Salesforce MarketRank™ Stock Analysis

- Overall MarketRank™

- 94th Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 10.0% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- Weak

- Environmental Score

- -0.60

- News Sentiment

- 0.46

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 12.03%

See Full AnalysisTake the Stifel team, for example. Analyst Parker Lane reiterated his Buy rating on Salesforce shares in the aftermath of last week’s report while boosting his price target up to $320. Considering Salesforce closed out last week at just over $250 a share, that’s pointing to a targeted upside of nearly 30%.

Lane noted he was particularly impressed with the “strength in bookings, current remaining performance obligations, and AI benefits.” He sees Salesforce as being “well positioned” to be a leader in the expanding use of AI in enterprise software. The team from Barclays agreed with this. They noted that the results should be good enough to convince what they called “nervous investors” who are still unsure if all the headwinds have been overcome.

However, the number of those investors should be dwindling, if not because of the company's strong fundamental performance but because of the bullish outlook of all these analysts. Barclays gave Salesforce a fresh price target of $305, while Bank of America went with $325 and Raymond James with $350.

Salesforce Poised for a Rally: High Expectations from Wall Street

In fact, of the 20 or so analyst updates that have come out on Salesforce shares in the past week, all but a handful have been reiterating their Buy or Outperform ratings, along with price targets close to, if not well above, $300 a share. Those few dissenters include the Piper Sandler, Loop Capital, and Citigroup teams. But even among these three, who all have the stock rated as Neutral, their price target are still $268, $270, and $290, respectively, well above the $252 that Salesforce shares finished last week.

You can’t help but feel Salesforce is a bit of a sleeping giant right now, with record revenue prints, close-to-record profitability prints, and widespread agreement among analysts that further gains are imminent. Don’t be surprised if we see Salesforce back trading near all-time highs in time for their next earnings report in November.

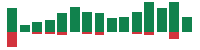

Salesforce, Inc. (CRM) Price Chart for Thursday, December, 26, 2024

Before you consider Salesforce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Salesforce wasn't on the list.

While Salesforce currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.