The Dow Jones Industrial Average, often referred to simply as "the Dow,” is a stock index that tracks the performance of 30 large, publicly traded companies listed on stock exchanges in the United States.

Stocks in the DJIA represent major consumer goods companies, many of which you'll recognize as everyday products. Read on to learn more about the DJIA, what stocks are in the Dow Jones and strategies for Investing in Dow stocks.

What is the Dow Jones Industrial Average?

The Dow is among the world's oldest and most widely followed stock market indexes. It comprises 30 large, publicly traded companies that are household names and leaders in their respective industries, such as Apple, Microsoft, Coca-Cola, Johnson & Johnson and Boeing.

Because the Dow often reflects broader market trends, investors, analysts, central banks and policymakers closely monitor it to gauge the overall health and direction of the United States stock markets. As such, price movements in the DJIA can significantly impact both investor and market sentiment and economic policy decisions.

The DJIA is a reference point for measuring the performance of investment portfolios, mutual funds and other financial instruments. To calculate the Dow, take the sum of the stock prices of its 30 companies and divide it by a divisor that is adjusted to account for stock splits, dividends and other corporate actions. Compared to other stock market indexes, the methodology behind this calculation is relatively straightforward. It is a price-weighted index, meaning that the individual stock prices are weighted according to their respective share prices rather than market capitalization.

This means that companies with higher stock prices have a greater influence on the index's movements, regardless of their actual market value.

History of the Dow Jones Industrial Average (DJIA)

The DJIA was created in 1896 by Charles Dow, co-founder of Dow Jones & Company and the Wall Street Journal. Initially, the Dow consisted of only 12 industrial companies, including General Electric Company NYSE: GE, American Tobacco and United States Rubber Company.

Over time, the many stocks in the Dow expanded to 30 companies, which remains unchanged today, representing a broad range of industries.

Throughout its history, the DJIA has witnessed significant milestones and market events, including the Great Depression, the post-World War II economic boom, the dot-com bubble of the late 1990s and the 2008 global financial crisis. Despite these fluctuations, the DJIA has remained a symbol of stability and continuity in the financial markets.

In recent years, however, advancements in technology and changes in the global economy have prompted discussions about the relevance and accuracy of the DJIA as a barometer of the stock market's health.

Overview of Companies in the Dow

The Dow uses a price-weighting strategy and includes only a select group of industry leaders, setting it apart from other indexes. Final decisions about which stocks are included in the Dow are made by an S&P Dow Jones Indices committee, specifically the Averages Committee.

The committee considers various factors such as the company's reputation, market capitalization, industry representation, history of sustained growth, and overall importance to the U.S. economy. The DJIA's composition changes to ensure that the index remains relevant and reflects broader market trends.

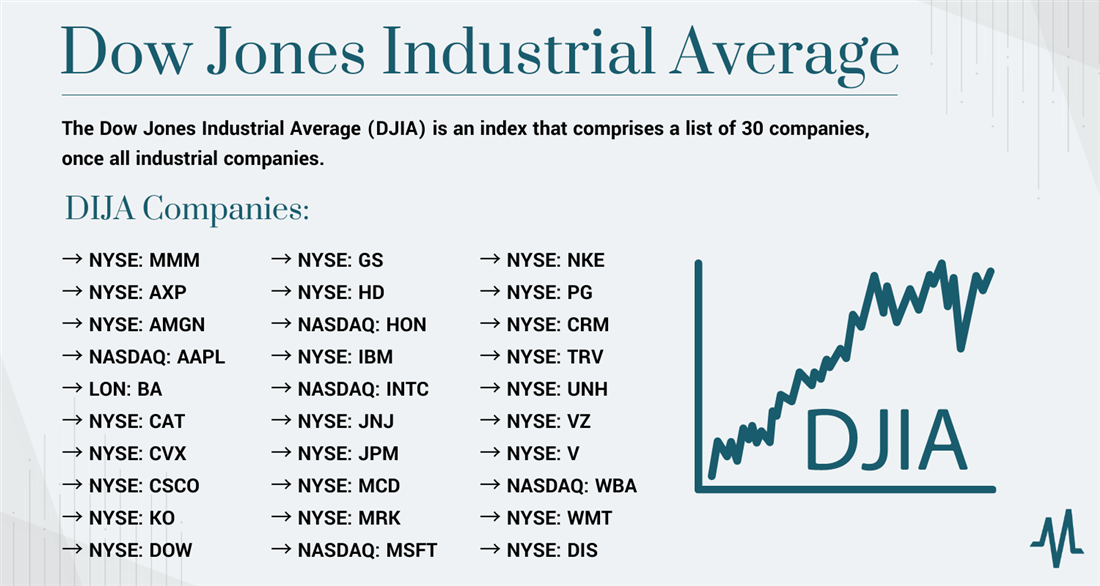

So what stocks are in the Dow? As of March 2024, the stocks on the Dow index include the following companies (in alphabetical order):

Importance of Individual Stocks in the Dow

While the DJIA comprises 30 large and influential companies, certain stocks have a more significant impact due to their higher market capitalization or price weighting within the index. Changes in the performance of these individual stocks can have a notable, and sometimes disproportionate, effect on the direction and magnitude of the Dow’s movements.

For example, suppose a high-priced stock within the DJIA experiences a significant price increase.

In that case, it can disproportionately impact the index's value, leading to an upward movement. Conversely, if a prominent stock in the index experiences a substantial price decline, it can weigh down the DJIA, causing it to decrease.

Changes in the performance of certain influential companies have often correlated with movements in the DJIA, reflecting broader economic trends, sector-specific dynamics and shifts in investor confidence. Positive earnings reports, product announcements or strategic initiatives from these companies can drive optimism in the market, leading to overall upward movements in the DJIA. Conversely, negative news or developments may lead to declines in the index.

Here are some examples of how historically influential Dow Jones stocks have impacted market trends and investor sentiment over time:

General Electric Company (GE)

GE faced significant challenges during the 2008 financial crisis due to its exposure to the financial services sector through its GE Capital division.

Concerns about the company's financial health and liquidity sent shockwaves through the market, contributing to broader market declines. GE's struggles during this time led to a significant decline in its stock price and raised concerns about the stability of other financial institutions and the overall health of the economy. The negative sentiment surrounding GE contributed to market volatility and influenced investor confidence.

International Business Machines

In 1981, IBM introduced the IBM Personal Computer (PC), revolutionizing the computer industry and establishing IBM as a dominant player in the emerging PC market. The success of the IBM PC paved the way for the widespread adoption of personal computers, driving growth in the technology sector and influencing investor sentiment toward technology stocks.

ExxonMobil Co.

In 1973, during the OPEC oil embargo, Exxon (before the merger with Mobil) saw a surge in its stock price due to increased demand and soaring oil prices resulting from the global oil supply disruption, contributing to overall market gains.

However, the sharp rise in oil prices led to inflationary pressures and economic challenges, impacting consumer spending and business investment. The rally in Exxon's stock price reflected the broader market's response to geopolitical events and changes in global energy markets.

Apple Inc.

In 2007, Apple launched the iPhone, which revolutionized the smartphone industry and transformed Apple's stock price and market trends.

The success of the iPhone not only boosted Apple's revenue and profitability but also drove investor enthusiasm for the company's future prospects. Apple's stock price surged following the iPhone launch, leading to significant gains in the DJIA and influencing market sentiment towards technology stocks.

The Boeing Company

In 2013, Boeing faced significant challenges following battery fires on its 787 Dreamliner aircraft, which led to regulatory authorities grounding the entire Dreamliner fleet. It had a detrimental impact on Boeing's stock price and market trends.

Concerns about the safety of Boeing's aircraft raised questions about the company's future prospects and its ability to address the technical issues. Boeing's stock price plummeted, contributing to declines in the DJIA and affecting investor confidence in the aerospace sector.

Analyzing the Current Composition

As the DJIA aims to provide a snapshot of the entire United States economy, it includes companies from most major sectors, including information technology, healthcare, communication services, consumer discretionary, finance, industrial, consumer staples, materials, utilities and energy. The transportation and utility sectors are typically excluded, as they are represented by the Dow Jones Transportation Average (DJTA) and Dow Jones Utility Average (DJUA), respectively.

Since its inception in 1896, the Dow has undergone numerous additions and removals of stocks to reflect the changing dynamics of the economy and financial markets to ensure that the DJIA remains a relevant and reliable benchmark for the stock market.

Here is a timeline of some notable additions and removals and the reasons behind these decisions:

1939: International Business Machines Co. Added

IBM's addition reflected the growing importance of technology and computing in the U.S. economy. As a leading manufacturer of tabulating machines and later computers, IBM became a symbol of technological innovation.

1991: United States Steel Co. Removed

Once a dominant force in the steel industry, United States Steel NYSE: X faced declining fortunes due to increased competition from foreign producers and structural changes. Its removal from the DJIA reflected its diminished significance in the United States economy.

1999: Microsoft Co. and Intel Co. Added

The addition of Microsoft and Intel reflected the growing importance of the technology sector in the late 20th century. As a dominant player in the software industry, Microsoft represented the shift towards technology-driven growth and innovation. As a leading semiconductor manufacturer, Intel played a crucial role in powering the digital revolution.

2008: Altria Group Inc. Removed

The Altria Group, Inc. NYSE: MO (formerly Philip Morris Companies) faced increasing regulatory challenges and declining tobacco consumption rates. Its removal from the DJIA reflected concerns about the long-term prospects of the tobacco industry.

2013: Nike Inc. and Goldman Sachs Group Inc. Added

These two companies enhanced representation in the consumer goods and financial services sectors. As a global leader in sports apparel and equipment, Nike brought diversity and growth potential to the index and Goldman Sachs’ inclusion reflected the significance of investment banking and capital markets within the economy.

2015: AT&T Inc. Removed, Apple Inc. Added

AT&T was removed to make room for the addition of Apple Inc. While AT&T was a telecommunications giant, its market capitalization was lower than Apple's, and its stock price had been relatively flat. Apple's addition reflected its status as one of the most valuable and influential companies globally, particularly in the technology sector. With its iconic products like the iPhone and iPad, Apple brought significant market capitalization and innovation to the DJIA.

2018: General Electric Removed

GE, once a bellwether of American industry, faced significant challenges, including declining revenues, regulatory issues, and asset write-downs. Its removal from the DJIA marked the end of an era and reflected its diminished stature in the corporate world.

Various factors, including macroeconomic trends, industry-specific factors and company-specific news, influence stocks' performance within the Dow. Understanding these factors is crucial for investors looking to make informed decisions regarding Dow stocks:

- Interest rate changes: When the Federal Reserve lowers interest rates, it may stimulate economic growth and lead to higher stock prices, while higher interest rates can have the opposite effect.

- GDP growth: Strong economic growth typically translates to higher corporate earnings and increased investor confidence, driving stock prices higher.

- Inflation: Rising inflation can erode purchasing power and affect consumer spending habits, directly impacting companies' revenues and profitability.

- Unemployment: Labor market conditions can affect consumer sentiment, discretionary spending and corporate profitability. Low unemployment rates may lead to higher consumer spending and higher stock prices.

- Regulatory changes: Government policies (such as banking regulations or healthcare policies) can significantly impact industries represented within the DJIA.

- Technological advancements: Companies that innovate and adapt to technological changes may outperform their peers, while those that lag may struggle.

- Commodity prices: Companies within the DJIA may be influenced by fluctuations in commodity prices; for example, changes in oil prices can impact the profitability of energy companies.

- Earnings reports: Positive earnings surprises may lead to stock price appreciation, while negative earnings surprises can result in stock price declines.

- Management changes: Changes in company leadership, such as appointing a new CEO or management team, can positively or negatively influence investor sentiment and stock prices.

- Product developments: Positive news regarding new products or business opportunities may drive stock prices higher, while setbacks or delays may lead to declines.

The best way to make an informed investment decision is to conduct thorough research, stay informed about macroeconomic trends and industry developments and diversify your portfolios. When performing your due diligence, carefully evaluate company fundamentals like earnings growth, competitive positioning and valuation metrics. By considering macroeconomic factors and company-specific news, you can better assess the risks and rewards associated with investing in Dow stocks.

Strategies for Investing in Dow Stocks

Looking to incorporate DJIA stocks into your portfolio? While you can't invest directly into the index itself, you have plenty of other options to get exposure to the companies in the Dow.

- Invest directly in DJIA stocks: Buying individual stocks that are part of the DJIA allows you to invest in the companies that make up the index directly.

- Turn to the “Dogs of the Dow”: This strategy aims to capitalize on high-dividend yields and generate income while potentially outperforming the overall market. At the beginning of the year, identify the 10 highest-yielding stocks from the Dow (known as the “dogs”), give them equal weight in your portfolio and hold them the entire year. At the end of the year, rebalance your portfolio based on the updated list of highest-yielding stocks for the upcoming year.

- Invest in ETFs that track the DJIA: Exchange-traded funds (ETFs) provide an easy way to gain exposure to the entire DJIA without buying each stock separately. ETFs like the SPDR Dow Jones Industrial Average ETF (DIA) aim to replicate the index's performance by holding the same stocks in the same proportions as the DJIA.

- Invest in mutual funds: Some mutual funds are designed to replicate the performance of the DJIA by investing in the same stocks that make up the index, providing you with exposure to the overall performance of the DJIA.

- Invest in index funds: Passively managed index funds that aim to replicate the performance of a specific index, such as the DJIA. Like ETFs and Mutual Funds, index funds that track the DJIA can provide exposure to the stocks within the index.

- Options and futures contracts: This is a great strategy if you are a more advanced investor as trading derivatives involves additional risks and may not be suitable for all investors.

- Dividend reinvestment plans (DRIPs): Some companies within the DJIA offer dividend reinvestment plans that allow investors to reinvest their dividends directly into additional shares of the company's stock. This can help you accumulate more shares over time and benefit from compounding returns.

- Sector rotation strategies: You can use sector rotation strategies to overweight or underweight sectors within the DJIA based on economic and market trends. You can potentially enhance returns by rotating into sectors expected to outperform and out of sectors expected to underperform.

- Dollar-cost averaging: This strategy involves regularly investing a fixed amount of money, regardless of market conditions. This strategy can help smooth out the impact of market volatility and potentially lower the average cost per share over time.

- Long-term buy-and-hold strategy: Instead of trying to time the market or engaging in short-term trading based on daily fluctuations, focus on holding quality stocks for the long term, typically years or decades, to benefit from compounding returns over time.

As always, it is important to perform thorough research and due diligence before making an investment by analyzing the company's business model, financial health, competitive position, growth prospects and management team. Reviewing financial statements, earnings reports and industry trends will also help you make an informed investment decision.

When determining your overall portfolio allocations, it is important to diversify your investments by including companies in both defensive and growth-oriented sectors within the DJIA. You may also consider including stocks from other indexes or asset classes, as they will provide additional diversification.

Once invested, you must monitor market trends, economic indicators and company-specific news, as they may impact DJIA stock performance. Regularly adjusting your investment strategy based on changing market conditions and new information is essential for maintaining a successful, diversified portfolio that aligns with your investment objectives.

While the DJIA is a major index, it is not the only way to measure the overall health of the American economy. The following major indexes may share some of the same assets but differ in weighting and inclusion criteria.

Nasdaq Composite Index

The Nasdaq Composite Index tracks the performance of more than 3,000 publicly traded companies listed on the Nasdaq stock exchange. The Nasdaq exchange is primarily known for listing technology and growth-oriented companies, but it also includes companies from other sectors such as healthcare, consumer services and finance.

Unlike the DJIA, which includes just 30 large-cap U.S. companies, the Nasdaq Composite Index is a broader market index that includes companies of all sizes and various industries. Additionally, the Nasdaq Composite Index is market-capitalization-weighted, meaning that companies with larger market capitalizations significantly impact the index's performance. This is in contrast to the Dow, which is a price-weighted index.

Overall, the Nasdaq Composite Index will give you a broader understanding of market price movements, while the Dow shows the performance of a select grouping of companies.

S&P 500 Index

The S&P 500 Index is a market-capitalization-weighted index of the 500 largest United States companies operating on publicly traded markets. Companies included in this index are chosen based on total market capitalization, liquidity and industry sector representation. The S&P 500 index is designed to represent a broad cross-section of the United States economy and includes companies from various industries.

Like the Nasdaq Composite Index, the S&P 500 Index is a broader market index than the DJIA. However, unlike the Nasdaq Composite Index, the S&P 500 Index only includes companies based in the United States.

Also, unlike the DJIA, the S&P 500 features a market-weighted calculation, which means that companies with more assets under control make up a larger percentage of the index. The DJIA's price-weighting structure gears the index more heavily towards assets with higher share prices. Learning more about comparing stocks or using another market news source can help you incorporate multiple indexes with different weighting structures into your portfolio.

Russell 2000

The Russell 2000 is another stock market index designed to track the performance of small-cap United States companies. The index comprises the smallest 2,000 companies in the Russell 3000 Index, a broader market index covering 3,000 U.S. companies.

The Russell 2000 Index covers many companies and a different segment of the United States stock market than the Dow, focusing on small-cap and large-cap companies. Like the Nasdaq Composite and the S&P 500, the data you receive from the Russell 2000 is more generalized across multiple market sectors than individual companies.

Pros and Cons of Investing in Dow Stocks

Before investing in the assets that make up the Dow, you must understand the index's pros and cons. Be sure to consider all of the following points before placing a buy order, and consider consulting with a financial professional before making any major financial decisions.

Pros

First, the benefits:

- Diversification: The Dow comprises 30 large, established companies from various industries, which can provide an instant level of diversification for your portfolio. A DJIA ETF can make the process of diversifying and protecting your initial investment even simpler.

- Long-term growth potential: Many of the companies in the Dow have a long history of success and stability and may continue to grow over the long term. The index is actively reassessed and evaluated, offering professional oversight you won't get through individual investing alone.

- Dividends: Many of the stocks in Dow 30 pay dividends, which can provide you with regular income.

Cons

Next, the downsides:

- Concentration: The Dow only tracks 30 companies, so your investments may focus on a few key industries. This can lead to higher rates of losses if the specific sectors you're buying into experience sharp losses.

- Limited exposure: The Dow is only made up of American companies so you may miss out on international opportunities. This can also lead to concentrated losses if the American economy turns negative.

Dow Stocks: Solid Companies, but not Bulletproof

There's a reason why the DJIA has remained a significant stock indicator since its inception more than 100 years ago. These companies are mainstays of the American economy, proving their worth by successfully weathering both bull and bear markets.

Considering how many stocks are in the Dow Jones Industrial Average, you have many options when adding one or more to your portfolio. However, new investors, in particular, need to remember that the stocks that make up the Dow represent only a small section of the American economy — and diversify accordingly.

FAQs

Let's look at some frequently asked questions about investing in the Dow and stocks in Dow.

What stocks make up the Dow?

The Dow comprises 30 American companies, each representing a major name in its sector. Some examples of well-known companies that make up the Dow include UnitedHealthcare, Coca-Cola and JPMorgan Chase.

How many stocks are in the Dow?

There are currently 30 stocks in the Dow Jones, which has been the case since 1928. While the Dow Jones has changed the number of companies included in the index in the past, it is now set at 30.

What is the biggest company in the Dow?

As of March 2024, the largest company in the DJIA by market capitalization is Microsoft, with a market capitalization of $3.09 trillion.

Before you consider American Express, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Express wasn't on the list.

While American Express currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.