Understanding this crucial benchmark is paramount for newcomers to the world of stocks and trading. Often mentioned in financial news headlines, the DJIA holds the power to sway markets and evoke a sense of anticipation among seasoned investors. But what is the Dow Jones Industrial Average, exactly?

We'll investigate the intricate tapestry of the Dow, decipher its inner workings and unravel the stories it tells about the success of prominent industries.

What is the Dow Jones Industrial Average?

A question often asked by new investors is, "What is the Dow Jones average?"

A Dow Jones Industrial Average definition would be that the Dow Jones Industrial Average, commonly referred to as the Dow, is a vital stock market index that provides insights into the performance of the largest and most influential publicly traded companies in the United States.

Created by Charles Dow and Edward Jones in 1896, the Dow serves as a snapshot of the overall health and direction of the stock market. The Dow is a barometer of market sentiment and economic strength and comprises 30 blue-chip companies across various industries, including technology, finance, retail and manufacturing.

So what is the Dow average? Unlike other market indices that weigh companies based on factors such as market capitalization, the Dow utilizes a price-weighted methodology, which means that companies with higher stock prices have a more significant impact on the index's movements. Consequently, the Dow often reflects how a select group of large, established companies fares in the market rather than a comprehensive representation of the entire stock market.

By tracking the fluctuations in the Dow, investors, analysts and economists can gain valuable insights into market trends, investor confidence and the economy's overall direction. As a widely recognized symbol of Wall Street, the Dow Jones Industrial Average has become ingrained in popular culture, with daily movements closely followed by millions around the globe.

Let's look at the fascinating components that shape the Dow and uncover the intricate factors that influence its ever-fluctuating value.

What Does the Dow Jones Industrial Average Measure?

The Dow Jones Industrial Average is an essential gauge for assessing the performance and direction of the stock market. Specifically, it measures the overall price movement of a select group of 30 large publicly traded companies that are considered leaders in their respective industries. As a price-weighted index, the Dow captures changes in stock prices of its constituent companies and reflects the cumulative effect of those price movements.

The DJIA's primary purpose is to provide insight into the health and sentiment of the stock market, acting as a barometer for investor confidence and economic conditions. It offers a snapshot of how the 30 chosen companies, spanning diverse sectors of the economy, are performing collectively. These companies include well-established giants such as Apple.com Inc. (NASDAQ: AAPL), Microsoft Corp. (NASDAQ: MSFT), The Boeing Company (NYSE: BA), Walmart Inc. (NYSE: WMT) and JPMorgan Chase & Co. (NYSE: JPM).

It's important to note that the Dow Jones Industrial Average does not directly measure the market capitalization or total value of all publicly traded companies. Unlike other indices, such as the S&P 500 or the Nasdaq Composite, the Dow's methodology does not consider factors like company size. Instead, it focuses on the stock price movements of its constituent companies.

The Dow is calculated using a divisor, which adjusts for factors such as stock splits, dividend payments and corporate actions. This divisor ensures that changes in the price of any individual stock do not disproportionately influence the index. While the specific formula used to calculate the DJIA is proprietary, the underlying concept is to sum the prices of all 30 stocks and divide them by the divisor.

As a widely recognized benchmark, the Dow Jones Industrial Average is a vital reference point for investors, traders, financial analysts and economists. It offers insights into market trends, investor sentiment and economic conditions, allowing market participants to make informed decisions based on the collective performance of the Dow's constituents.

Understanding that the Dow is not a comprehensive representation of the entire stock market is crucial. With only 30 companies, it may not capture the full breadth and diversity of the thousands of publicly traded companies in the United States. Therefore, other indices often use it to obtain a more comprehensive view of the overall market performance.

History of the Dow Jones Industrial Average

The Dow Jones Industrial Average has a rich and storied history that dates back to its creation in 1896 by Charles Dow, one of the founders of Dow Jones & Company, a company renowned for establishing The Wall Street Journal. At its inception, the DJIA tracked and measured the stock market's value, providing investors and analysts with a snapshot of the economic landscape.

During its early years, the DJIA consisted of a modest index of 12 stocks, reflecting the economic composition of the late 19th century. Interestingly, this original index predominantly comprised 10 railroad stocks, underscoring the dominance of the railroad industry at that time, along with two industrial stocks. However, Charles Dow soon recognized the shifting dynamics of the economy, with the industrial sector gaining prominence over railroads.

In response to this evolving landscape, Dow created a separate index exclusively for railroad stocks, which remains today as the Dow Jones Transportation Average. Simultaneously, he reconstituted the DJIA with a new list of 12 stocks focused on the flourishing industrial sector. Over time, the index grew and expanded its coverage to reflect the changing face of the American economy.

In 1916, the DJIA underwent its first significant expansion when it added four additional stocks. Another substantial change occurred in 1928 when ten more stocks were introduced, bringing the index's total components to 30. These 30 companies are carefully selected based on their influence and representation across various industries.

While changes to the DJIA's constituents have been relatively infrequent since these early adjustments, the index has gradually shrunk its components over time. Other companies have replaced all of the original Dow stocks included in the index's charter. Notably, the last of the original Dow stocks, General Electric, was replaced in 2018, marking the end of an era.

The history of the Dow Jones Industrial Average is an enduring testament to its adaptability and relevance in capturing the pulse of the American economy.

Components of the DJIA

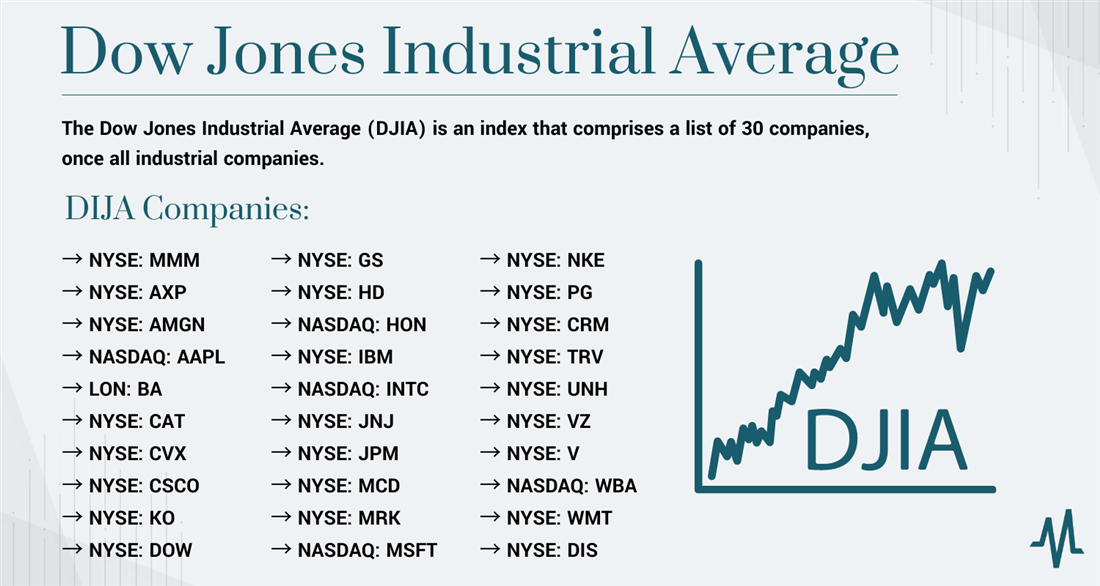

At the heart of the Dow Jones Industrial Average (DJIA) lies a carefully curated ensemble of 30 companies that form the index's components. These selected corporations, hailing from various industries, are considered industry leaders and represent the backbone of the American economy. Together, they serve as the driving force behind the Dow's ability to gauge market performance and offer insights into economic trends.

Example of a Company on the Dow

McDonald's Corporation (NYSE: MCD) stands as an exemplary company within the Dow Jones Industrial Average, embodying the essence of its position as a leader in the fast-food industry. Founded in 1955, McDonald's has evolved into one of the world's most recognizable and iconic brands, with a global presence spanning over 100 countries.

As a fast-food restaurant chain, McDonald's operates a vast network of company-owned and franchised restaurants, serving millions of customers daily. Renowned for its emphasis on consistency, convenience and affordability, the company has established itself as a dominant force in the quick-service restaurant sector.

So why does McDonald's find itself among the esteemed constituents of the Dow? McDonald's inclusion in the index stems from several key factors. First and foremost, McDonald's plays a significant role in the American and global economies. Its sprawling operations generate substantial revenue, creating jobs and contributing to the economic landscape.

Moreover, McDonald's financial performance, demonstrated by its consistent growth and profitability, makes it an attractive candidate for the DJIA. The company's ability to adapt to changing consumer preferences, introduce innovative menu items and expand its digital capabilities have fueled its success and market capitalization.

Additionally, McDonald's status as a consumer staple further strengthens its position in the Dow. The company's brand recognition, global footprint and enduring popularity make it resilient to economic fluctuations. As a consumer staple stock within the consumer staples sector, McDonald's is considered a defensive stock. Defensive stocks add stability to investment portfolios. This defensive stability is why McDonald's institutional ownership is over 50%, as investment managers seek stability to offset more volatile stocks. McDonald's ability to weather economic downturns and maintain consistent product demand adds strength and reliability to the Dow Jones Industrial Average.

Furthermore, McDonald's serves as a representative of the broader food and beverage industry within the DJIA. Looking at McDonald's competitors can help you understand why including a prominent player from this sector allows the index to capture the pulse of consumer spending, trends and overall economic sentiment.

By featuring McDonald's as an integral component, the Dow Jones Industrial Average incorporates a company that exemplifies the intersection of business success, consumer behavior and economic impact. McDonald's ability to adapt and thrive in a rapidly changing market landscape underscores its relevance and inclusion in the Dow.

McDonald's strategic initiatives and long-term vision align with the index's focus on industry leaders. The company has demonstrated its commitment to sustainability, innovation and technological advancements, embracing digital ordering, delivery services and menu diversification initiatives to meet evolving consumer demands.

As one of the most recognized brands in the world, McDonald's carries significant weight and influence. The company's performance and strategic decisions can reflect broader trends in the food industry and consumer sentiment, making it a valuable indicator within the Dow Jones Industrial Average. Investors interested in this blue-chip stock need to stay abreast of changes in the company by monitoring McDonald's news headlines and McDonald's social media chatter. Monitoring what McDonald's is currently doing or is rumored to do in the future could give you insight into the best time to purchase or sell McDonald's stock.

How to Choose Dow Stocks

Investing in stocks can be a rewarding endeavor, and one of the most esteemed indices to consider when selecting stocks is the Dow Jones Industrial Average (DJIA). The Dow's collection of 30 prominent companies represents various industries and offers investors a glimpse into the broader market performance. However, choosing the right stocks from this elite group requires careful consideration and analysis. So let's take a moment to review the process of selecting Dow stocks.

Step 1: Research and familiarize yourself with the DJIA.

Before diving into stock selection, conducting thorough research and gaining a solid understanding of the Dow Jones Industrial Average (DJIA) is crucial. Familiarize yourself with the index's history, methodology and the significance of its components. Take the time to study the sectors represented within the DJIA and get acquainted with the industries and companies that make up this renowned index.

Step 2: Define your investment objectives.

Clearly define your investment objectives before choosing a DJIA stock. Determine whether you aim for long-term growth, income generation, diversification, or a combination of factors. Assess your risk tolerance, considering how comfortable you are with potential fluctuations in stock prices and identify your investment time horizon. Additionally, decide on the amount of capital you are willing to invest in DJIA stocks.

Step 3: Conduct an in-depth company analysis.

Once you understand your investment objectives, comprehensively analyze the individual companies listed on the DJIA. Evaluate their financial health, competitive advantages, growth prospects and overall performance. Analyze key financial metrics such as revenue, earnings per share (EPS), debt levels and return on investment (ROI). Consider market share, brand strength, innovation and sustainability initiatives to make informed decisions.

Step 4: Evaluate industry and market conditions.

In addition to analyzing individual companies, evaluate the industry and market conditions surrounding the DJIA stocks you are considering. Assess the current state and future outlook of the industries represented within the index. Keep a close eye on market trends, economic indicators and factors that may impact the sectors relevant to your investment choices. Stay informed about geopolitical events, regulatory changes and technological advancements that could influence the stock's performance.

Take the time to monitor the performance and historical data of the DJIA stocks you are interested in. Review the stock's price volatility, dividend history, stock splits and any significant events that may have impacted its value. Utilize financial news platforms, stock market research tools and analyst reports to gather relevant information. Analyzing past performance lets you understand how the stock has fared in different market conditions.

Step 6: Consider dividend yield and payout history.

Consider whether dividend income is an essential component of your investment strategy. Evaluate the dividend yield and consistency of dividend payouts for the DJIA stocks you are considering. Examine the company's dividend growth rate and ability to sustain and potentially increase dividend payments over time. Dividend-paying stocks can provide a steady income stream and potentially enhance overall returns. If obtaining a passive income is your goal, choosing the best dividend strategy that will work for you is essential to your overall portfolio strategy.

Step 7: Diversify your portfolio.

To manage risk effectively, aim for a well-diversified portfolio by considering stocks from various sectors within the DJIA. Allocate your investments across different industries to mitigate the impact of any single sector's performance on your portfolio. Diversification allows you to capitalize on opportunities in multiple sectors while reducing the potential adverse effects of any one stock's underperformance.

Step 8: Place your trade.

Once you have conducted thorough research, defined your investment objectives and chosen the DJIA stocks that align with your strategy, it's time to place your trade. Open a brokerage account with a reputable firm that provides access to stocks listed on major exchanges, including the DJIA. Fund your brokerage account with the desired investment capital.

Ensure that you have sufficient funds available to execute your investment decisions effectively. Most brokerage platforms offer various funding options, such as bank transfers or electronic payment methods, making depositing funds into your account convenient.

Step 9: Utilize the brokerage's trading platform.

Once you fund your brokerage account, use your chosen brokerage's trading platform. These platforms offer intuitive interfaces that allow you to place orders for DJIA stocks seamlessly. Specify the DJIA stock quantity and symbol you wish to purchase. Choose between market orders, executed at the current market price, or limit orders, where you set a specific price at which you want to buy the stock.

Step 10: Monitor and review your investments.

After purchasing DJIA stocks, monitoring and reviewing your investments is crucial. Stay updated with company news, quarterly earnings reports, quarterly earnings calls and market developments that may impact the performance of your chosen stocks. Monitor the overall performance of your portfolio and assess whether it aligns with your investment objectives. Consider reviewing your holdings periodically and making adjustments as needed to ensure they continue to align with your evolving financial goals.

By following these comprehensive steps, you can confidently navigate picking and purchasing stocks listed on the DJIA. Remember that investing involves risks, and it's essential to stay informed, exercise due diligence, and consult with professionals when necessary to make informed investment decisions.

Limitations of the Dow

Despite its recognition and influence, the Dow Jones Industrial Average has limitations. As a price-weighted index, the DJIA's components are determined by their stock prices, which can create distortions and give greater weight to higher-priced stocks, regardless of their actual market significance. Additionally, with only thirty components, the DJIA may only partially represent the diverse range of industries and sectors, potentially limiting investor exposure to investment opportunities. Furthermore, the exclusion of small-cap stocks and the lack of sector representation can hinder investors from accessing emerging industries or gaining a comprehensive understanding of sector performance.

The infrequent changes in the DJIA's components may delay the inclusion or exclusion of relevant companies, while the index's sole focus on stock prices overlooks critical fundamental factors. These limitations underscore investors' importance in considering alternative indices, conducting additional research and utilizing comprehensive tools to make informed investment decisions that align with their goals and risk tolerance.

Is the DJIA Still Relevant?

The relevance of the Dow Jones Industrial Average in today's investing landscape is a topic worth exploring. Despite its historical significance and widespread recognition, it is important to critically examine whether the DJIA remains pertinent in today's dynamic and evolving financial environment.

The DJIA holds symbolic importance due to its long-standing legacy and widespread recognition. It has become deeply ingrained in popular culture as a reference point for the performance of the U.S. stock market. The index's association with prominent financial news outlets, such as The Wall Street Journal, further contributes to its enduring significance in the public eye.

However, one of the primary limitations of the DJIA is its limited representation of the overall market. With just 30 major U.S. companies included, the index offers a narrow snapshot of the broader market. This limited sample may not fully capture the diverse range of industries, sectors and market trends, potentially hindering investors from comprehensively understanding the overall market dynamics.

Furthermore, the DJIA's exclusivity excludes smaller companies and companies representing growth stocks, particularly small-cap stocks, that may possess higher growth potential or represent emerging industries. As these smaller companies are often drivers of innovation and can significantly impact the market, their exclusion from the DJIA may limit the index's ability to reflect evolving trends and capture the full breadth of the market's performance.

Another factor to consider is the DJIA's methodology. The index is price-weighted, meaning that higher-priced stocks have a more significant influence on its movements. This approach can lead to distortions, as the price of a stock does not necessarily reflect its market capitalization or the company's overall significance. The price-weighted methodology can skew the index's market representation, potentially impacting investors' perception of overall market trends.

Additionally, the DJIA's composition changes infrequently, with adjustments made selectively. While this provides stability and historical continuity, it may delay the inclusion or exclusion of companies that have gained or lost relevance over time. As a result, the DJIA's slower component change process may not fully reflect the evolving market landscape and may limit its ability to capture emerging trends.

In recent years, alternative indices, such as the S&P 500 and Nasdaq Composite, have become more comprehensive and representative benchmarks of the U.S. stock market. These indices often encompass a broader range of companies, employ different weighting methodologies and include additional criteria for index inclusion. As a result, they may offer a more robust and inclusive representation of the market for investors seeking a comprehensive view.

While the DJIA's relevance may be subject to ongoing scrutiny, you must recognize its symbolic and historical significance. It remains a widely recognized and followed index, and its movements continue to impact market sentiment. However, investors should be mindful of the limitations inherent in the DJIA's methodology and composition, considering alternative indices and comprehensive market analysis to make informed investment decisions in today's complex financial landscape.

From Dow to Now: Navigating the DJIA's Influence

The Dow Jones Industrial Average (DJIA or "the Dow") is an iconic symbol of the U.S. stock market and continues to hold cultural and historical significance. However, investors must be aware of its limitations, such as its narrow representation and price-weighted methodology. While the DJIA remains widely recognized, alternative indices and comprehensive research can offer a more inclusive market view.

As investors navigate the ever-evolving financial landscape, understanding the DJIA's role and considering a broader range of benchmarks and analyses will empower you to make more informed investment decisions. By embracing the complexities of the market and leveraging the wealth of information available on sites like MarketBeat, investors can navigate toward achieving their financial goals with confidence and adaptability.

FAQs

Navigating the world of investing can be an exciting yet challenging endeavor. To address common questions and concerns, we have compiled an FAQ section for investors seeking clarity on various aspects of the Dow Jones Industrial Average (DJIA) and its significance in the financial landscape. Whether you are a beginner or an experienced investor, these frequently asked questions provide valuable insights and answers to help you make more informed decisions regarding understanding and utilizing the DJIA as a benchmark for your investment journey.

Why is the Dow Jones important?

The Dow Jones Industrial Average (DJIA) holds importance as one of the most widely recognized stock market indices globally. It serves as a barometer of the overall health and performance of the U.S. stock market. Many investors, analysts and institutions closely monitor the DJIA as it provides insights into the general trends and sentiment of the market. Its long-standing history and symbolic significance contribute to its importance in the financial world.

Is it better to invest in Dow Jones or S&P 500?

In this article, we discussed "What is Dow Jones" However, the choice between investing in the Dow Jones Industrial Average (DJIA) or the S&P 500 ultimately depends on individual investment goals and preferences. The DJIA comprises 30 large, established companies, while the S&P 500 represents a broader index of 500 large-cap U.S. stocks. The DJIA's limited composition may appeal to those seeking more exposure, while the S&P 500 offers broader diversification across sectors and companies. Investors must consider their risk tolerance, investment strategy and objectives before deciding which index aligns better with their needs.

How many companies are in the Dow Jones Industrial Average?

The Dow Jones Industrial Average (DJIA) currently consists of 30 companies. However, it is important to note that the number of companies included in the DJIA today has changed. Initially starting with 12 stocks in 1896, the index expanded over the years, and the current composition includes 30 component stocks. The index committee determines the selection of these companies and aims to represent various sectors and industries within the U.S. economy.